Financial Freedom: How to Find Peace And The Work-Optional Life You Truly Want

Picture this: you power through another long day, inbox on fire, calendar packed, and you catch yourself thinking, I wish I could work less. That pull for options, whether it’s the peace of mind of having your bills paid off or the freedom to go part-time or retire early, is real. And yes, it’s possible. […]

Sinking Funds Made Simple: What They Are, Why They Work, How to Use Them

Imagine this: a coworker texts you from the repair shop, heart racing, because her car needs $780 she hadn’t planned for. Two weeks later, holiday gifts hit, then school photos, then the dog’s meds. Sound familiar? That pileup steals focus, sleep, and your hard-earned momentum. Here’s the fix you can actually stick with: a sinking […]

How to Stop Falling Behind Financially and Catch Up Fast

Many people realize later in life that they are falling behind financially and lack a savings plan, feeling the pressure of financial uncertainty. Is this you? Without a clear strategy, financial anxiety can take over, leaving you stressed and unprepared for unexpected expenses and future goals. This uncertainty can make long-term stability seem out of […]

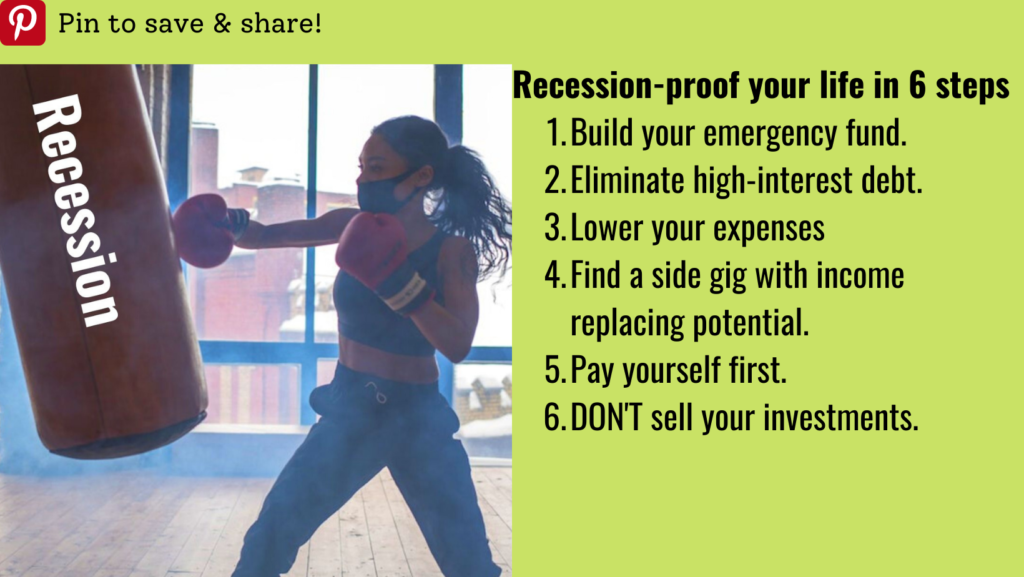

How to recession-proof your life in 6 steps

Recessions are a natural part of our economy. They are generally unpleasant but if you’re prepared, you can ride it out. However, if you’re not ready, you can REALLY feel the pain. So it is essential to establish habits now to recession-proof your life to ride out the current one and the ones to come. […]

3 Steps to Deciding How Much of Your Paycheck to Save

Having savings is a given, right? However, saving is not always simple. It takes some forethought but once you have your system down pat, it’ll be so common nature that you’ll be saving without thinking about it. So here are the 3 steps to take to decide how much of your paycheck to save. How […]

Set Yourself Up for a Healthy and Successful 2022

Let’s talk about some goals you can choose to improve your physical and financial health. 2021 is coming to an end. Honestly outside in 2021 was only mildly better than that disastrous 2020. However, there were some bright spots. I got to travel at the end of November and my financial picture looks as good […]

The Best Way to Successfully Build An Emergency Fund

Today’s post is graciously shared by Frugal Beans, our frugal friends from Sydney, Australia. After reading this post, get to know them by visiting their blog and/or following them on Instagram @frugal_beans. Why do you need an Emergency Fund? An Emergency Fund is fast becoming an integral part of the common budget. To give your […]

How to Save Money and See Results!

The three initial steps to getting your money in order, in my opinion, are saving, debt management, and investing. And in that order. That does not mean you can only do one at a time but your focus shouldn’t be on investing if you don’t have any savings. Why is saving money so important? Where […]

Do You Need a Financial Advisor to Manage Your Money?

There’s a wide variety of advice out there as to whether or not you should get yourself a financial advisor. The short answer is no, most people don’t NEED a financial advisor. However, if you don’t get one, you might be missing out. So in this post, I’ll share my own personal experience with a […]

Do You Really Save Money with a Costco Membership?

The answer is YES! I don’t favor things that have a huge buzz around them. If everyone else is hyped about something, I’m usually hesitant to engage in it. So I never thought I would hop on the Costco bandwagon and buy a membership. I actually resisted it at first only going with friends instead […]