Car insurance is one of THE most flexible of all your necessary expenses. You can change your insurance at any time. You can change your level of coverage and your deductible to save money on your car insurance. There are a variety of discounts available to you at any given moment. But you have to put in a little work. I saved hundreds by shopping around for car insurance using a few different methods.

READ MORE: How to save way more money on car insurance

Background

Just for clarification purposes, the information you are seeing is personal to my household. So if you’re paying more or less for car insurance, you can assess for yourself what is working for you or not. I am not for or against any of the insurance providers discussed here. Simply put, I am here for the savings and the savings alone.

In July 2020, I paid $844.65 for 6 months of car insurance coverage with GEICO (about $140.78/month). I always pay in full as much as possible because doing so usually saves money. In January 2021 though, I was billed $1,003.10 (about 167.18/month). If you wanted me to go, you could have just said so. I’m gone.

To be fair, the $844.65 I paid was because GEICO was still providing the Giveback Credit of $172.75 and I increased the deductible on my collision insurance (which saved me another $131). Still, paying over $1,000 for 6 months when it is just the two of us and one car just felt preposterous. So per my usual six-month schedule, I went shopping for car insurance to see if I could save money.

Shopping around for car insurance

Typically, I reach out to a broker that I have worked with in the past. This can be a hands-off approach to shopping for car insurance. However, I have been able to beat the prices she has quoted me for about two years now. So that’s no longer a good use of my time. I’m not against the use of one. It just is no longer working out for me.

So instead I looked up my car insurance info document which I keep in my cloud. I keep a list of my household’s violations and accidents with dates. Also, listed here are details related to our car and when we took our defensive driving course. I saw the quotes I got from last time. This was helpful because I spent less time on companies that routinely charge more. In this document, I calculate the monthly cost of each quote I receive. This is important because while most policies have a six-month term, there are some who cover you for 12 months. So in order for me to do a true comparison, I calculate the monthly cost of each quote.

Savvy came across my radar this year. For ease of use, you can use their site to log into the online account you have with your insurance. Otherwise, the option is to fill out the forms manually. I honestly didn’t find this tool very useful. Even though I logged into my insurance account, it still took me to the landing pages of other insurance companies for quotes. So it didn’t save me time or money.

Policygenius is a company I heard about from the ChooseFI podcast. It’s easy to use. Just upload your declaration page to your home and auto insurance and it searches for quotes. It takes a few days to get results but it’s similar to having a broker. The customer service interactions were very pleasant. Though I didn’t take the insurance they recommended, they thanked me for trying their service and asked very nicely why I made the choice I did.

I saved money on my car insurance

The quote I received from Policygenius was $868 for six months with Traveler’s if I also got home insurance with them. It was $913 if I went with another company for home insurance. This was definitely cheaper than what I was quoted for renewal with Geico. I didn’t choose either of these policies for two reasons.

- When getting auto insurance with Policygenius, it appears you are also to get home insurance with them. I’ve had my home insurance policy since I moved here and haven’t seen any reason to change it.

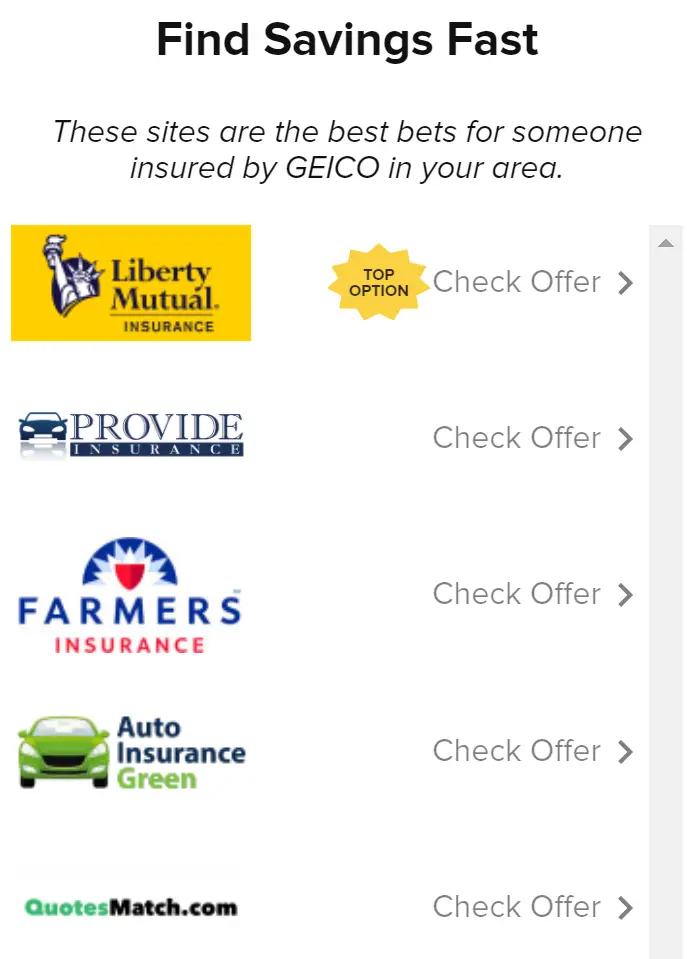

- I was able to find a better deal with Liberty Mutual. Though it costs more than one of the Traveler’s quote at $887 for 6 months, the deductibles were SIGNIFICANTLY smaller. I initially had $2000/$5000 deductibles for comprehensive and collision coverage respectively. With Liberty Mutual, you could not have a deductible greater than $1,000 for each. AND this is without bundling my home insurance. This is a savings of $116 every six months as their term is for one year, rather than 6 months.

Available Car Insurance Savings

Why do costs vary so much across different companies? Each company has its own way of assessing risk. The riskier you appear, the more expensive your insurance is. Also, they decide what sort of discounts to apply.

Are you in school? Have you taken defensive driving? Have you kept insurance on with no gaps in coverage? Early shopper discount? Are you paying in full? Bundling your car and home insurance? Signing your documents online? Allowing them to track your driving habits? These are just some of the many discounts a company may take into account when providing you a quote.

As a side note, the early shopper discount I just came across when shopping. If you purchase your policy a week or more prior to when you want them to start coverage, you may qualify for this discount. When looking to save on car insurance, check to see if this is a discount you can take advantage of.

Typically, you can seek insurance quotes at any point. You do not have to wait until renewal time to seek out quotes in order to save money on your car insurance. Whatever balance is left on your current policy, if you paid in full, will be refunded to you. If you pay monthly, the same idea. You’ll get a sort of pro-rated refund.

With this change, I am saving a little over $200 this year on my car insurance. If we can hold off on getting any more tickets or getting into any accidents, then I look forward to that price coming down even further.

Use Kelley Blue Book to see how much your car is worth. Once it’s value has dropped low enough where it doesn’t make sense to carry comprehensive and collision insurance, you can remove that coverage and save yourself even MORE money.

Photo by Andrea Piacquadio from Pexels

Your turn. When’s the last time you shopped around for car insurance? What discounts do you take advantage of? What is your preferred method for shopping around for car insurance savings? Share in the comments below.

Wow! It’s pretty eye-opening how much can be saved when you really look at your options. Great post!

Great Article, although saving is important, I would opt to save anywhere else but the deductible, the more you pay on the deductible, the better coverage you get. Cheers.