Budgeting for Couples: How to Talk About Money Without Arguing

You’ve worked so hard to build your career. But when it comes to money and your relationship, things can feel messy, emotional, and scary. You’re managing your income, your goals, maybe even your debt… and trying to figure out how to merge (or not merge) finances with the person you love. As a newly married […]

The Real Reason You Feel Spending Guilt (and How to Break Free)

If you’re reading this, you’re probably tired of feeling that tight knot in your stomach every time you spend money. You want to enjoy your life, buy things you care about, and still feel like you’re being smart. You might also be looking for tips on how to plan ahead, stick to a budget that […]

Financial Freedom: How to Find Peace And The Work-Optional Life You Truly Want

Picture this: you power through another long day, inbox on fire, calendar packed, and you catch yourself thinking, I wish I could work less. That pull for options, whether it’s the peace of mind of having your bills paid off or the freedom to go part-time or retire early, is real. And yes, it’s possible. […]

How To Set SMART Financial Goals For Success

Let me level with you: most of us were never taught how to set real financial goals. I’ve worked with women who felt like they were doing all the “right” things with money, yet still felt lost or frustrated. So if you’ve ever felt that way, you’re not alone, and there’s a better way. Money […]

Sinking Funds Made Simple: What They Are, Why They Work, How to Use Them

Imagine this: a coworker texts you from the repair shop, heart racing, because her car needs $780 she hadn’t planned for. Two weeks later, holiday gifts hit, then school photos, then the dog’s meds. Sound familiar? That pileup steals focus, sleep, and your hard-earned momentum. Here’s the fix you can actually stick with: a sinking […]

How to Stop Falling Behind Financially and Catch Up Fast

Many people realize later in life that they are falling behind financially and lack a savings plan, feeling the pressure of financial uncertainty. Is this you? Without a clear strategy, financial anxiety can take over, leaving you stressed and unprepared for unexpected expenses and future goals. This uncertainty can make long-term stability seem out of […]

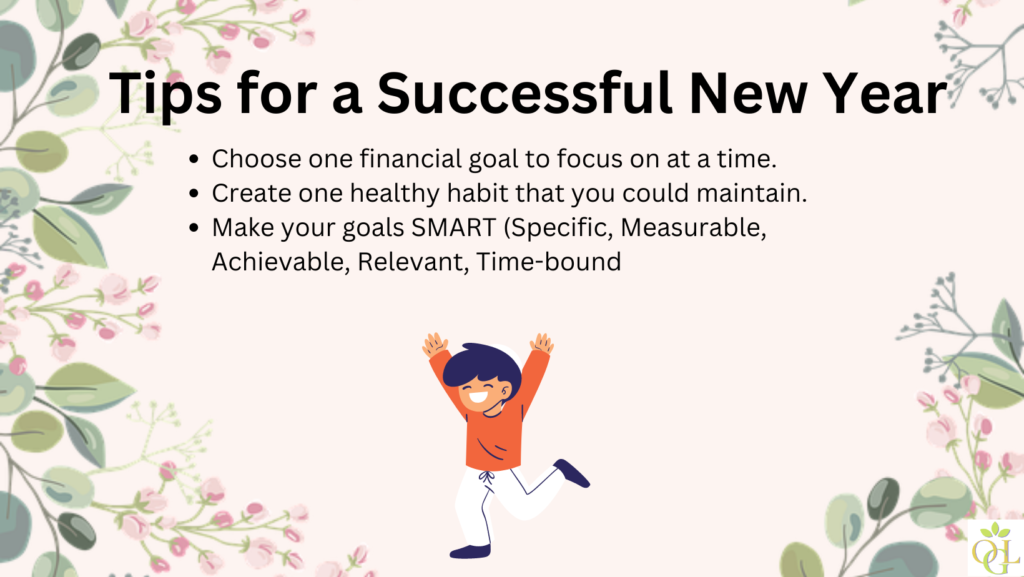

2023: The Year of Achieving Your Goals and Finding Success

Do you have big or small goals that you want to achieve in 2023? Whether you want to improve your health or your finances, setting and working towards goals can be a powerful way to make positive changes in your life. Put Your Money to Work for You If you’re reading this and feel like […]

How To Behave In A Bear Market

The stock market is plummeting! What do I do? The best thing to do in a bear market is to stand still. Don’t stand still literally. But figuratively, you don’t want to make sudden or unexpected moves. You want to keep the strategy you have in place. Why? Because the stock market plummeting is not […]

3 Steps to Deciding How Much of Your Paycheck to Save

Having savings is a given, right? However, saving is not always simple. It takes some forethought but once you have your system down pat, it’ll be so common nature that you’ll be saving without thinking about it. So here are the 3 steps to take to decide how much of your paycheck to save. How […]

5 Essential ETFs to have in your portfolio

What are ETFs? Before deciding what ETFs to have, you should have an understanding of what they are. An ETF is an exchange-traded fund. This is a collection of all types of investments that are packaged together for sale on the stock market. An ETF allows you to invest in an industry without having to […]