New Financial Update – Q1 2021 Results

I think a quarterly review is in order. It is important to take the time to look over your plans to make sure the decisions you made months ago still align with where you want your finances to go today. So in this post, I’ll go over my financial picture thus far in 2021. As a head’s up, I know there are quite a variety of financial situations going on this past year because of the pandemic. This is not to minimize that. Hopefully, even if you can’t make all of these moves, maybe one or two of the decisions I make for myself might be useful to you. If not, at least create goals you can implement in the near future.

Increasing Income

Being a nurse has a lot of income potential. You can have a multitude of jobs either all per diem or one full-time and one or more per diem opportunities. If you’re in the midst of choosing a career, consider nursing.

READ MORE: How to Save Money on College Costs

I have one full-time salaried position as a nurse navigator. I also have a per diem position doing home visits for a home care company and another working in an office processing home care referrals for another home care company.

Performance Reviews

At my full-time job, we have annual performance reviews where you rate yourself, your boss rates you, and some peers rate you. How well you do determines the percentage raise you will receive. Fun fact: did you know that women are less likely to share their “wins” even when asked? That means less money down the line. When I learned this, I was determined to make a change. I started writing down my unique contributions to my workplace. How have I made my job more efficient? How have I streamlined processes that currently exist? Who have I worked with to make those changes happen? What are examples of how I have gone out of my way to make something happen for a patient? What new skills have I attained? What new programs have I used? Have I taught anyone how to make use of these skills and/or programs for their work? These are questions you should be able to answer and if you don’t write them down as they are occurring, you are likely to forget and miss some amazing contributions you are making to your workplace. This also, in my experience, makes it much easier to talk about them.

READ MORE: How to Get a Raise

So the first full year I was there, I got a 4.0 out of 5.0. I didn’t give much value to the questionnaire because it was the first time, to my recollection, that it made a significant difference financially. Also, my boss’s ratings either mirrored my own or she rated me higher than I rated myself. That also made me realize that if I don’t acknowledge my efforts, it will be much harder for others to recognize what I bring to the table. So this year, I sat down with my self-appraisal and I entered comments laying out how I exceed the expectations set in front of me as an employee. This year, my score is 4.8 out of 5.0. When my score was 4.0, my raise was 3.26%. Last year, I got 4.6 out of 5.0 and my raise was 4.26%. As of last year, I believe that was the highest raise you can receive so I look forward to my compensation statement this year letting me know how much more to expect. Coronavirus makes me nervous they might have shifted the scale but we’ll see. Whatever the case, I should receive the maximum available raise.

Per Diem Work

My office job has been on hiatus ever since the pandemic began. That money usually went directly to my 403b anyway so I didn’t miss the money. My other job where I do home visits reaches out to me when they need help staffing cases. I am very selective because fortunately, I am in a position where they need me more than I need them. That is not to be conceited. Now that I have decreased my expenses down to where my full-time job more than covers what I need, any other work now is purely voluntary. It does provide a measure of comfort knowing that I have options and I use skills that I wouldn’t otherwise use anymore in my day-to-day work.

So first of all, I have picked up more short-term cases than I usually do. Secondly, I negotiate higher pay in one particular county because the traffic in that county is usually horrendous and parking can be a nightmare. More than half of the cases they ask me to fill are from that county so it always feels good to say yes when I’m up for it. The amount of money I make depends on how many cases I take and I usually do at minimum one visit a month or at a maximum of about five visits a month. So whatever money I make splits into two savings accounts: my personal sinking fund and my household’s sinking fund.

READ MORE: Let’s Negotiate!

Uber Eats

I started about a month ago and the findings have been quite interesting. The barrier of entry is very low making anyone who has a method of transportation eligible to start in just a matter of days with no money down. You have to pass a background check and if you’re driving, this includes your driving record. I have made from $20-37/hr delivering food usually once a week after work. I have not yet decided what I am going to do with this extra money though it is likely that I will invest it in my Roth IRA. I just want to devote some time to make sure there’s nothing I am missing that I may want to put the extra money toward first. Usually, this is about an extra $90 a week for four hours of work.

READ MORE: I Did Uber Eats for a Week – Learn How to Best Use It to Actually Make Money

Bonuses

Periodically, we get bonuses at work. Typically, I put it all towards my Roth IRA. My latest bonus was $500 which tragically became $320 after taxes. I chose to use $95 to pay the annual fee on my American Express card. The rest I put in my Roth IRA.

READ MORE: Got Extra Money Coming?

Why do I choose to pay an annual fee on my American Express card? I earn about $13 a month in cash back for grocery (6%) and streaming service purchases (6%). This means I make about $156 a year. If you subtract the annual fee, that means I make an extra $61 a year on expenses I would make anyway. In addition, there are bonuses throughout the year that gives additional cashback when I shop at certain retailers. In 2020, that was an extra $25. So it’s worth it so far. I’ll have to keep tabs on it though because I have been spending more money on groceries at Costco (who doesn’t take American Express) than at my regular grocery store.

See Simple Ways to Save Money on Groceries

Decreasing Expenses

The easiest way to get a little breathing room between paychecks is to decrease expenses. The main expense I have been able to eliminate temporarily is my $173.71 life insurance premium. My policy had dividends that I did not make use of so I use those tax-free earnings to pay my premium. If I just took that money, I would have to pay taxes on it. I was able to pay up until September before they cut me off because you can’t pay too much in advance.

READ MORE: I Broke Up with my Life Insurance Agent – Here’s Why

Next expense: groceries. I have gotten a lot better at shopping with a list which has helped to keep my spending under control at the grocery store, especially Costco. I meal plan before going aiming to start with ingredients I already have in the house. I make a list based on what I plan on cooking. My husband and I share this list on Google keep which allows us both to add items in real-time as they are running out. If we don’t keep this list updated, we ALWAYS forget routine purchases. This means an extra trip to the grocery store so we try to avoid it.

READ MORE: Simple Ways to Save Money on Groceries

Finally, I return items I don’t value. If an item isn’t worth returning, then it probably wasn’t worth buying in the first place. This sounds a little backward but hear me out. If you purchase a pair of shorts, for example, and you didn’t love it when you tried it on after you got to your home, then you should return it. Otherwise, you have spent your hard-earned money on something you may never wear. I make it a point now not to keep items that I feel so-so about. I want to value everything I keep in my surroundings. Otherwise, it just feels like clutter. If you do find quality items in your home that no longer “spark joy”, then consider donating them. It could mean the world to someone else.

One thing I could spend some time on is comparing prices for electricity for my home. There are potential savings there that I could be missing out on.

Investing More

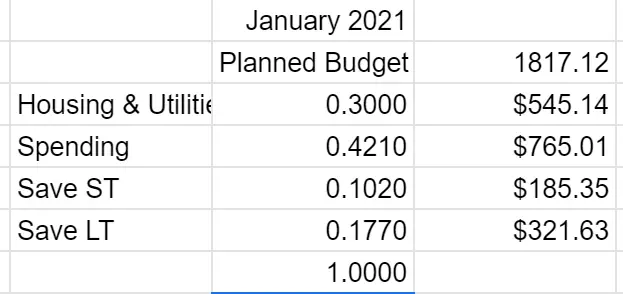

First, I simplified my budget to make it clearer how much I spending versus saving. So after I put 21% of pre-tax money in my 403b, about 42% of my check goes toward expenses. The 30% toward housing really goes into a savings account that pays for our household expenses. So not all of it is spent. Short-term (ST) savings never changes at about 10%. The change comes with Long-term (LT) savings. This brings us to point #2.

Secondly, I used to pay off the credit cards completely before deciding how much truly goes to LT savings. So if my credit card balances were $800, for example, then I would take the extra $35 away from my LT savings. So while my budget says to use $765 for spending and $321 for LT savings, I would apply it as $800 for spending and $286 for LT savings. Does that make sense?

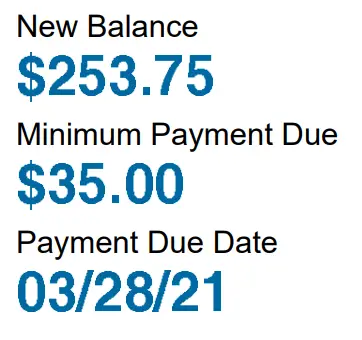

So instead, this past month I decided to try the pay yourself first model completely. So I don’t ever change how much goes to housing or ST savings. I put the $321 in my Roth IRA for LT savings. Then, I divvied up the $765 among my credit cards. I was reluctant at first because I don’t like to keep any balance on my credit cards if I can help it. However, to avoid credit card interest, the only principle that is required to maintain is that you pay off the statement balance by the due date. How do you know how much that is? At first, it is your credit card statement.

Second place you can check if you’re not paying the full balance all at once like me, your credit card’s account page.

If your bank doesn’t have it set up this nicely, you can look at your statement date and add up how much you have made in payments since that date. Does it add up to your statement balance? If so, great. You won’t get charged interest. If not, and it is in your power to do so, pay it.

This restructuring I thought would leave me with higher balances that I would be comfortable with. However, since I am not currently paying a life insurance premium and I’m keeping tabs on my food expenses, I was able to bring all four credit card balances to zero except for one. The balance on that was about $71. Totally okay to get paid next paycheck.

This amazing revelation means I get to invest more today without getting overwhelmed by my credit card balances. So more of my money will be in the market earning its keep. Currently, my investment accounts total about $172,000. It wasn’t too long ago that I was telling you about my first $100K. While in total, I invest about $2,000 a month, the value of my accounts has been growing by approximately $7,000. I am on track to max out my 403b for the year (2021 limit: $19,500) and will max out my Roth IRA (2021 limit: $6000).

The Highlight Reel

- Maximized my upcoming raise by writing down and sharing my contributions to the workplace

- Made extra money through per diem nursing opportunities and Uber Eats

- Temporarily eliminated my life insurance premium

- Could save more by shopping around for electricity

- Invest first, pay credit cards right after. I didn’t want to say pay credit cards later because I don’t want to imply holding off on paying off credit cards.

So these are the financial changes I’ve made in the last few months. They have the potential to compound upon each other to increase my net worth even faster.

READ MORE: Why Invest in the Stock Market Today

Your turn. What changes have you made or are looking to make to improve your financial picture? What challenges have you met? Share in the comments below.

4 Steps to Being Debt Free —

[…] 403b. After I fully funded my Roth IRA, I continued to invest in my brokerage account. Check out my financial update for more […]

Financial Update - Results Quarter 3 2021 —

[…] my last quarterly update, I shared how I complete my performance reviews to highlight the value that I bring to the […]