Why Invest in the Stock Market Today

Some people associate investing in the stock market with getting rich, gambling, or just plain old stress. If you feel that way, I encourage you to think of things a little differently. Despite the yo-yo-ing the market has done secondary to COVID-19, investing for your long-term savings is what most financially savvy people will advise.

How I Got Started

I remember distinctly how I got started with investing. I was working at Walgreens, having just started college. One of the managers, a middle-aged black woman who thought it was important for this young black woman to get started, put me on to the need to get investing. She told me about Sharebuilder (it no longer exists) and I started to stash money there. Just like that, I was investing in the stock market. There was no further guidance provided to me so I used it to hide money from myself. Put the money far away so I wouldn’t just squander it. Eventually, I used some of my earnings to buy a car. I knew nothing about how to invest but I got started. So if you haven’t started yet, hopefully, this will inspire you to do so.

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

READ MORE: How to recession-proof your life in 6 steps

Where Am I Today?

As I mentioned in my introductory post, I started listening to personal finance podcasts and read JL Collin’s Simple Path to Wealth. Now my investments total about $100,000 among six accounts. Now depending on where you are in your financial journey, that may sound like a lot. To others, it may sound like a little. It matters little because one’s personal finance journey is just that…personal. So it is up to me to judge mine and up to you to judge yours. So what do you want your money situation to look like?

When should you start investing?

Simple answer: today! There are so many ways to invest in the stock market today. The technology has made it available through an abundance of apps and some work hard to make it easy for you to grasp the concept of how to invest in the stock market. My personal favorite in this space is Stash* but there are TONS out there.

*If you use a referral link in this post to open an account, it may lead to you and I receiving a referral bonus

Losing Money in the Market

To be clear, when investing, the only time you lose money in the stock market is when you sell your shares for less than you bought them. All that being said, it does not make it easier to see your savings plummet during an economic downturn or fall. The longer you have been investing though, the less the falls and hits hurt.

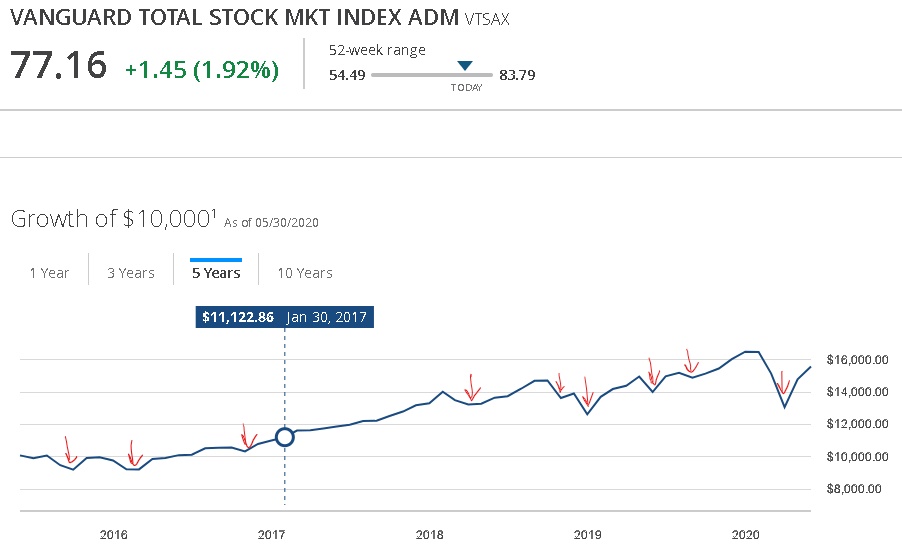

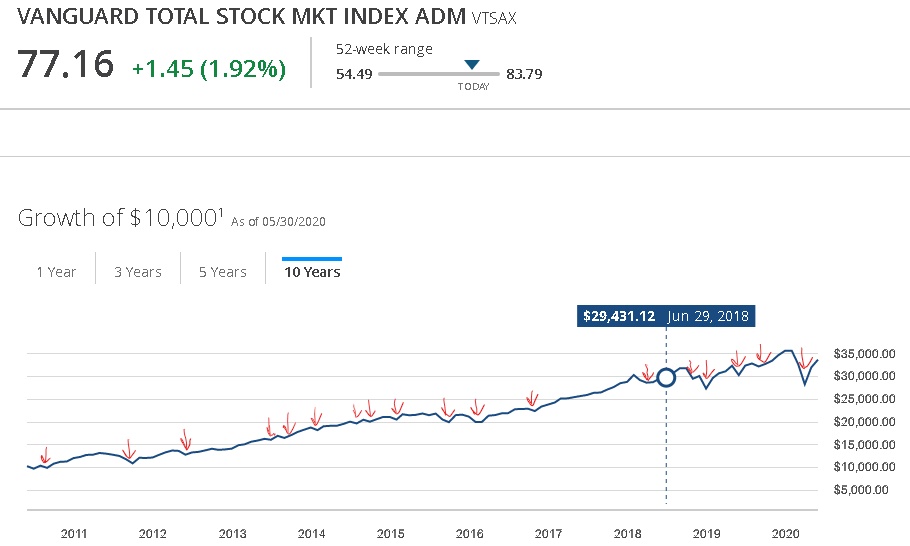

So the above picture points out what people describe as dips or falls in the market. However, if you started investing in 2016, that same money you invested, would still have been at a higher value during the massive drop this year 2020. And it’s for this reason that many people in the personal finance space would encourage you to invest money that you won’t need for at least 5 years. As you can see in the picture below, the longer you are in the market, the less bumpy the road looks. So plan for the long haul.

Why should you invest today?

When the market dipped, I was a little excited. Not to see my investment values drop, of course, but to have the opportunity to buy shares on sale. The market has been going up pretty consistently since before I started to invest with a purpose. So while the values of my initial investment went up, I wished I bought in earlier. Who doesn’t right? But that’s even more reason to start today. So that tomorrow, you don’t wish you had bought in earlier.

There was a great video I watched this week on investing. It’s linked below. He is worth subscribing to if you’re interested in investment videos. His approach is very balanced when it comes to investing. Plus, he also does real estate investing, if that interests you.

How do you invest?

The simplest way is within your retirement account. Your employer will take out whatever dollar amount or percentage you request up to the IRS annual limits. It will invest automatically in whatever funds you choose from the list provided to you. Once you set it, unless you change your investment strategy, you can forget it.

Image by TheDigitalWay from Pixabay

If a retirement account is not available to you from your workplace, then open an IRA. There are two, traditional and Roth, that you need to look into to decide what’s right for you.

Those options are tax-advantaged accounts where you save on taxes now or later. When you’ve used up those options, you can shift to a taxable brokerage account. There’s no limits to how much you can save there.

Remember that no matter what option you choose, there’s no minimum to contribute. So if all you can manage for now is 1%, then invest 1%. If it’s $5, then invest $5. Just start. Pick one or two mutual funds and build up your coin.

Image by Kevin Schneider from Pixabay

This money can help you save for a funding a business you imagined starting. Or saving money for your children. For me, I want to be able to help my family if needed without the stress of being broke. Also, I don’t want to make important decisions based on the fact that I’m hard up or desperate. It provides a cushion so that I don’t have so much anxiety about my finances. Don’t we all have better things to worry about?

To-Do List

- If you haven’t started yet, start investing today.

That’s it. If you haven’t invested yet in the stock market, what is stopping you? What concerns come to mind when you think about investing? If you have invested, what successes or pitfalls have you encountered? Share in the comments below.

Learn more basics on investing by checking out “Let’s Get Investing“.

Thomas

Great post. I played around and bought some stocks on the cash app when the quarantine first hit. Managed to make $3G off my investments and then pulled everything out. I know long term is the key, so now im considering what stocks to invest in for the long term. I read books like “the intelligent investor” but it was a little difficult for me to fully get into the book.

I have a retirement account and an IRA so my personal stocks would be the 3rd form of investments. What criteria would you look for to determine whether to invest in a particular stock?

P. Benson

Honestly, investing in individual stocks stresses me out. I want my decisions to be simple and I don’t want feel like I want to look at the ticker every day. So I prefer total stock market index funds. Preferably those who have the stocks I would want to invest in.

If you’re set on individual stocks, learn how to determine their value (there’s info out there on P/E ratios and other ways to assess their actual versus stated value). Stocks in tech since that’s not a market that will go away is not a bad idea. During the downturn, I invested heavily in American airlines. Whenever travel picks back up, that should also skyrocket. It already has once.

P. Benson

Also the Simple Path to wealth is a much easier read

Mina

Great info. I have been looking at the stock market for some time now. This is helpful.

P. Benson

Thank you. Hope you reach your goals! 🤗

Abbey

This is an area I’m super nervous about getting into but know I should!! I love all your info and am checking out Stash now! Thanks!

Gina Abernathy

Thanks for these tips. The stock market is way over my head to understand. I’ll keep checking back for more tips.

Justin Carm

I’m a 20 year old who dropped out of university not sure where to go from there, a year later I got 10,000 in small cap high risk dividend stocks and its changed my life! thank you for talking about this more people need to learn about investing, i am entirly gratefull i found out so early.

P. Benson

You’re definitely one of the fortunate ones. Continue investing.

How To Save More Money on Your Electric Bill —

[…] you do with the extra savings? Build the life you want. Add to your emergency fund. Pay down debt. Start investing. You can even use the extra money to save up to buy something you need or […]

How to tell when you're being frugal or being cheap —

[…] You create more room in your budget so you can save more towards your financial goals. Pay down debt. Build that emergency fund. Start investing. […]

How To Create A Routine To Get Results You Want —

[…] made available to you, sign up for a certain amount or percentage to come out with every check. Investing is great for working toward long-term savings (money you won’t need for ten years or more). If […]

Got Extra Money Coming? —

[…] This could help you tackle debt, build your emergency fund, save for a particular goal, start investing, […]

New Financial Update - Q1 2021 Results —

[…] READ MORE: Why Invest in the Stock Market Today […]

Investing with Stash - Great App for Beginner Investors —

[…] READ MORE: Why Invest in the Stock Market Today? […]

Let's Get Investing!!! —

[…] is the gateway to long-term savings. Do you feel like you have to be a special kind of person to invest? Think it’s too […]

How to Invest - What You Need to Know About Using Mutual Funds —

[…] of investing by now. If you don’t, check out my other articles Let’s Get Investing and Why Invest in the Stock Market Today. Prior to investing, you want to have at least $1,000 in an emergency fund. Then while you’re […]

How Much Do You Need in an Emergency Fund? —

[…] would have lost time in the market. It is said that the best time to invest was yesterday. The next best time is today. So to balance these goals, I would recommend saving $1000 in an emergency fund BEFORE diversifying […]

How To Behave In A Bear Market —

[…] READ MORE: Why Invest in the Stock Market Today […]