How to Invest – What You Need to Know About Using Mutual Funds

Hopefully, you know the importance of investing by now. If you don’t, check out my other articles Let’s Get Investing and Why Invest in the Stock Market Today. Prior to investing, you want to have at least $1,000 in an emergency fund. Then while you’re beefing up that emergency fund and paying off your debts, you want to start investing, even if it’s $5 at a time. The simplest way is to invest in index mutual funds. This article will cover how to identify the fees associated with an account, the costs of mutual funds, and how to diversify.

What are index mutual funds?

Mutual funds are a compilation of stocks, bonds, and other assets put together by a financial institution. These mutual funds usually have a set goal or requirements in order for a stock to be listed within that fund. They can be actively or passively managed. An actively managed fund is usually trying to beat the market so they are frequently buying or selling assets to make the most money. However, keep in mind that each transaction costs money.

An index fund is a broad term for mutual funds or ETFs (exchange-traded funds) that track aspects of the financial market. So an index mutual fund is a mutual fund that tracks an aspect of the financial market. This is managed passively. For example, the S&P 500 consists of the 500 top companies in the US. Companies who no longer meet criteria are replaced routinely with better-performing ones. As a result, index mutual funds as a whole perform well and with little to no work from you.

So if you’ve decided to make use of index mutual funds, let’s talk about what you need to know about how you invest in them.

How much does it cost to have the account?

First, you have to consider how much it costs to have the account that house the mutual funds you are going to invest in. You can invest in mutual funds in your retirement account or a brokerage account. The account itself may be free but usually, there is a cost. This can be listed as an account maintenance fee or program fee. For some companies, there is a flat fee. Stash, for example, charges me $1/month. On the other hand, my work 403b’s charge a percentage of my account or what’s you may hear referred to as a percentage of assets managed.

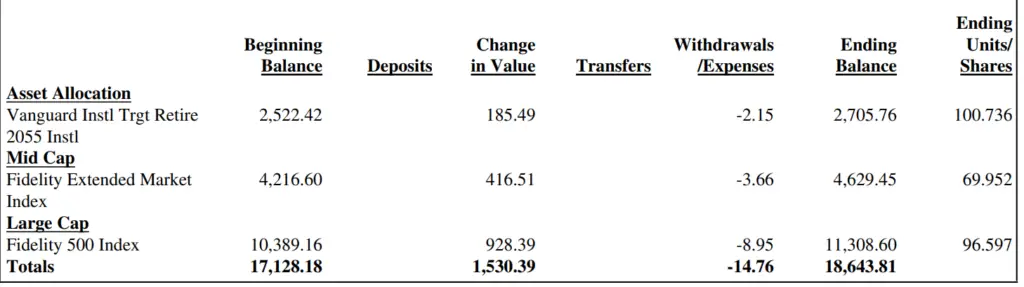

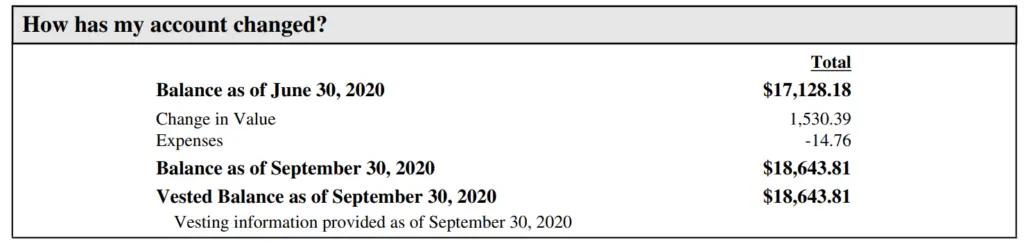

If you already have an investment account, no matter who it’s with, then check to see if those fees are reasonable to you. I will refer to the July – September statement from my 403b I have with my per diem nursing job. As pictured below, the charges on my account were a total of $14.76. I’m not sure how they calculate it but the fee is pretty minimal. The math works out to be about 0.01%. All that to say, if your job’s retirement account is charging fees that eat away at your gains, you might be better of funding your retirement elsewhere.

How much does it cost to own the funds you choose to invest in?

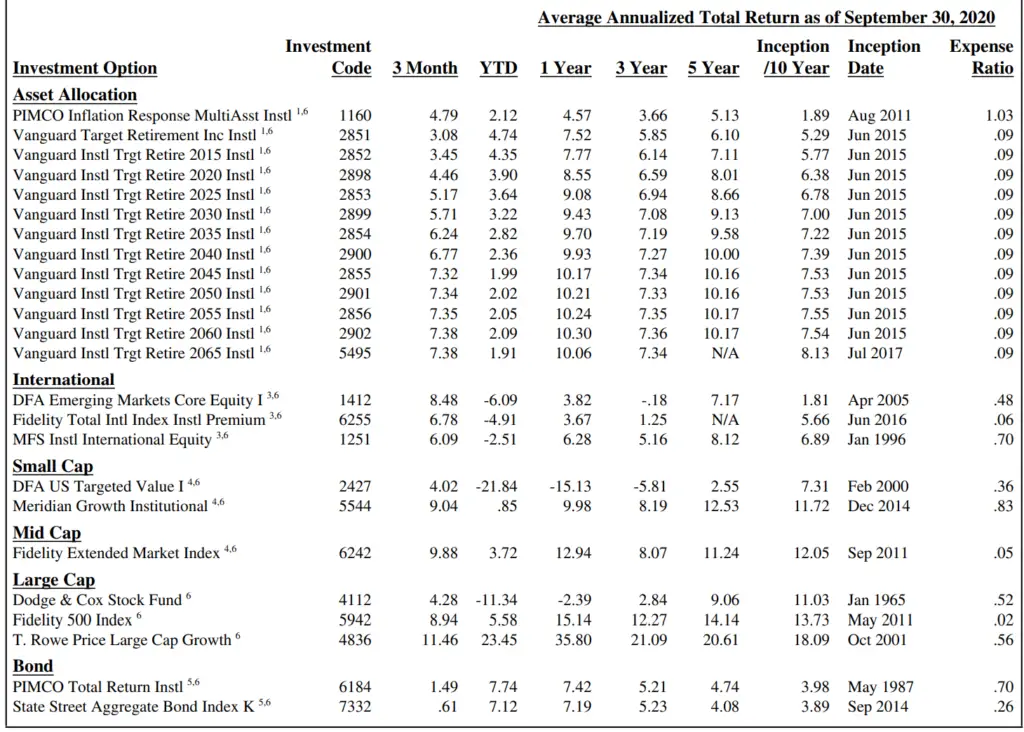

This is called an expense ratio. The more active the management, the higher this cost tends to be. Ideally, you want this number to be as small as possible. Why? If the expense ratio is 0.02, then that means you are charged $2 for every $10,000 invested. If the expense ratio is 1.03, then you are charged $103 for every $10,000 invested. Do you see the difference? So the smaller your expense ratio, the more money in your pocket.

This is not the sole factor in choosing what to invest in but it is a powerful one. Having higher expense ratios and perhaps a more active management approach does not always translate to higher returns. You can refer to the chart below. Your job’s retirement plan will have a short list of mutual funds you can choose from. Take the time to compare the funds available to you. This will help you decide what to invest in.

Diversifying

If you’ve consumed content regarding investing, then diversifying your portfolio is likely a term you’ve heard before. What it inherently means is that you have different asset types within your investment accounts.

Now if you’re investing within your retirement account, and you want to keep things simple, then putting investing all that money in a target-date retirement fund is the way to go. This fund will grow with you as you get older. It starts with a riskier, more stock-based portfolio when you’re younger to a more bond-based portfolio as you get older. Jean Chatsky of HerMoney recommends this sort of fund if you want to set and forget your retirement savings. Choose the fund that’s closest to the year you want to retire and allocate 100% of the money you intend to invest there.

However, if you want to be more involved, then consider which assets you want to invest in. If you refer to the last picture I shared, you can see the different fund types available within my 403b. They are international , small cap, mid cap, large cap, and bond funds. Just keep in mind, the further out you spread your money, the smaller the compounding effect. I can only think of food references when discussing this so here goes. If you have one tablespoon of salt and four pots of water. If you put a little bit in each pot, then each pot will be mildly seasoned. But with each pot you take away, that same tablespoon of salt split among them, goes way further in seasoning that water. That make sense? If you have a better analogy, share in the comments.

Within this account, as the first picture shows, I invest in three funds out of all the funds available to me.

Other considerations

These other considerations mainly apply to investment accounts you’re managing yourself like a brokerage account or an IRA.

- Transaction fees: find out how much it will cost you to buy or sell an index fund.

- Investing in causes that matter to you. Socially responsible funds allow you to invest broadly in environmental and social causes. You can check with your bank to see which ones are available to you. Use the same principles we discussed earlier to maximize your growth.

- Minumum investments: some funds have a minimum buy-in. This can discourage some investors who are looking to invest in index mutual funds. However, the beauty of using index funds is that there are other options to invest in that are inherently the same. For example, VTSAX (Vanguard Total Stock Market) has a minimum investment of $3,000. SWTSX (Schwab Total Stock Market) has no minimum investment. Both are tracking the same thing which is the entire market.

Another point I wanted to reiterate is the value of being in the market. If you refer back to the first picture of my account, you’ll note that there are no deposits. I have not worked at this job pretty much since the pandemic started. As a result, I haven’t made any contributions to the account since about April. Yet, my rate of return for this period is 8.8%. This should reassure people who worry about not having money to consistently invest. Just get started. While consistency is best, getting started is the most important.

Your turn. What do you look for in an investment account? How do you choose what to invest in? Do you invest in index mutual funds? Share in the comments.

Elaine

Thanks for all this great advice. Will share on my facebook page.

Lindsay

I’m all about ETFs. It doesn’t have to be complicated to be successful!

P. Benson

This is true!

Krista

Great resource! Thank you for putting all of this together!

Cindy

I’m all about vanguard, easiest way to do it! Good resource!

How to Make the Best Use of Limit Orders —

[…] of my money is invested in index mutual funds. It makes investing simple with great results. So if you want to keep it simple, I would look for […]

How to Make Your Money Grow Fast...ish —

[…] READ MORE: How to Invest – What You Need to Know About Using Mutual Funds […]

Why You Should Have Money In An IRA Now —

[…] READ MORE: How to Invest – What You Need to Know About Using Mutual Funds […]

Investing with Stash - Great App for Beginner Investors —

[…] READ MORE: How to Invest – What You Need to Know About Using Mutual Funds […]

ETFs versus Mutual Funds: Which Should You Be Investing In? —

[…] Mutual funds are a compilation of stocks, bonds, and other assets put together by a financial institution. These mutual funds usually have a set goal or requirements in order for a stock to be listed within that fund. The biggest difference between ETFs and mutual funds is that mutual funds are traded once a day so the price only changes once a day. […]