Why You Should Have Money In An IRA Now

Individual retirement accounts (IRAs) are powerful investment tools. It allows you to save money for retirement, regardless of whether or not you have a retirement account available to you at work. The only requirement for having an IRA is that you are making IRS-approved money.

How Do IRAs work?

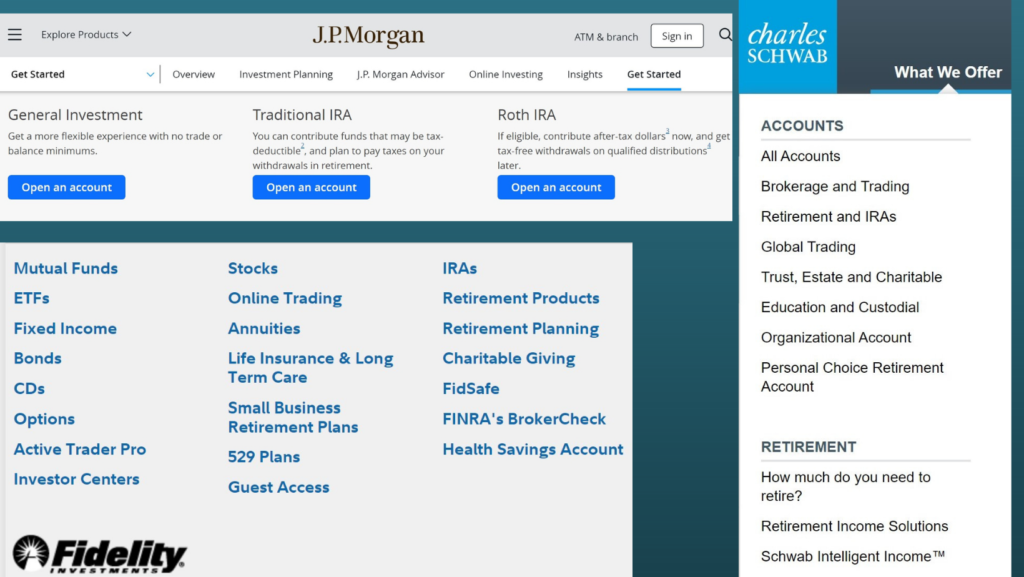

You open an IRA with a brokerage that has IRAs as an investment product. IRAs have tax benefits where taxes are deferred now or in the future. Once you open an IRA, you can invest in stocks, exchange-traded funds (ETFs), and mutual funds.

Where to Open an IRA

If anyone asks me where to open an IRA, I always suggest they start with their bank. A lot of the major banks have investment products available to their customers. Plus, you already have a relationship with them. So explore your bank’s product page. If they do not offer investment products, a simple Google search will provide a whole bunch of options. Nowadays, a lot of banks are allowing you to trade commission- and fee-free. That means it costs you $0 to own the account and $0 to buy and sell securities (stocks, ETFs, mutual funds). Some platforms are easier than others to navigate so factor that into your search, especially if you’re a beginner.

READ MORE: Nix Fees & Never Get Charged By The Bank Again!

Types of IRAs

There are Traditional, Roth, SEP, SIMPLE, and Spousal IRAs. This post will discuss Traditional and Roth IRAs. If you would like more information about the other IRA offerings, check out Investopedia’s article about your IRA options.

Traditional IRA

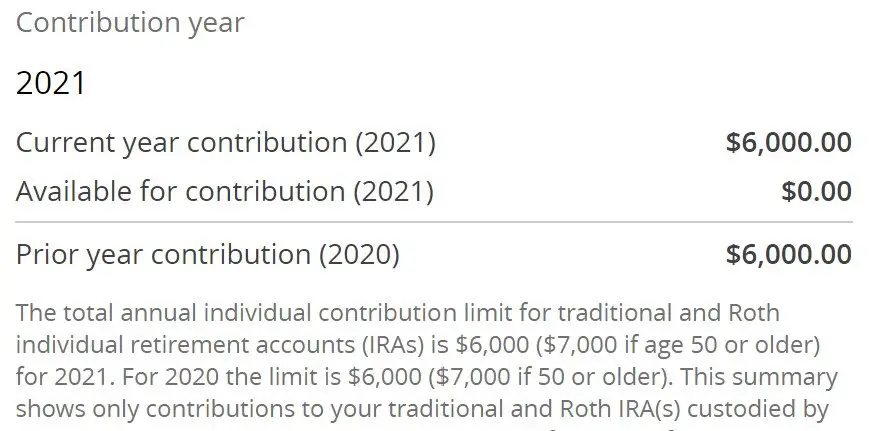

Traditional IRAs act like your 401k/403b at work. It allows you to save on taxes today. IRS limits you to contributing $6,000 a year. The tax benefits vary depending on your individual situation. For specifics, check out the IRS website on deductions. Generally, if you are contributing to a traditional IRA, you can deduct it from the taxes you owe that year. Simple example: if you were going to owe the IRS $300 but you contributed $6000 to your traditional IRA. The IRS will refund you $5700. If you and/or your spouse has a retirement account at work or you make above the IRS income threshold, you may only get a partial deduction or none at all.

When you turn 50, you can make extra contributions. They call them catch-up contributions. In 2021, that’s $7000 a year. When you turn 59 1/2 years old, you can start taking the money out of your IRA without penalty. When you take the money out (also known as a distribution), it is taxed as income. So the traditional IRA saves you on taxes today but you pay taxes in the future.

Roth IRA

When you contribute to a Roth IRA, you do not get a tax benefit today. HOWEVER, you get to grow the money in it tax-free AND you don’t pay taxes when you take the money out. IRS limits you to contributing $6000 a year and your ability to contribute depends on how much money you make. There are phase-out limits where you are allowed to contribute but less than the annual $6000 limit. Then once you make past $140,000 for single people or $208,000 for married, you cannot make a direct contribution to the Roth. You can still contribute but we’ll talk more about that later. There is no tax deduction as this is an after-tax contribution for tax-free growth and tax-free distributions.

You can make catch-up contributions once you turn 50, the same as the traditional IRA. A cool benefit of a Roth IRA is that for most people, you can freely take out the money you have put in. This money is referred to as your basis. This makes the Roth IRA a great place to keep an emergency fund for those who are comfortable investing it. However, you can’t take out the growth. For example, you contributed $6000. But over time, it grew to $6300. You can take out UP TO $6000 without penalties. You do not have to be 59 1/2 years old to do this. However, you have to be 59 1/2 to access your gains penalty-free.

This can be extremely powerful. Let’s say you contribute the max for five years. You would have put in $30,000 ($6000 x 5) and at 6% interest, it would have grown to about $41,000. Now let’s say you wanted that money for a down payment on a house or to pay off an unexpected medical bill. You could take out up to $30,000 penalty-free and leave the $11000 to continue to grow. I don’t recommend ever using the money you’re saving for the future for something today but things happen. If possible, you want to leave that money untouched for as LONG as possible.

READ MORE: How Much Do You Need in an Emergency Fund?

Backdoor Roth Conversion

This option is not a different investment product. For those who are above the income threshold to contribute directly to a Roth, this option is for you. You need to open both a traditional IRA and a Roth IRA for this to work. You can contribute directly to a traditional IRA regardless of your income, up to $6,000 a year. You can then do a conversion where the contents of your traditional IRA transfer into your Roth IRA. This is a taxable event so you will need to pay for that conversion. However, once the money is in your Roth IRA, it gets to grow tax-free and you can take distributions after 59 1/2 years old tax-free.

Point to note: The $6000 limit is across all your IRAs. So you can’t contribute $6000 to a traditional IRA and $6000 to a Roth IRA in the same year. Pro tip: have both accounts at the same institution. They can help you keep track of where you are.

Once you open an account, you have to choose what to invest in. Otherwise, it will remain in your account as cash and will not grow. So do your research and make the choices that are right for you. If you want to keep it as simple as possible, I recommend you check out The Simple Path to Wealth below. Author J. L. Collins presents an investment strategy that is dummy-proof.

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

READ MORE: 5 Essential ETFs to have in your portfolio

READ MORE: How to Invest – What You Need to Know About Using Mutual Funds

Your turn. Do you have an IRA? What are your goals with it? Have any questions about IRAs? Share in the comments below or contact me.

Amara Uche

great post!! So important to stay informed on our finances! Here in Canada we have different names for our accounts but the concepts are the same! Thanks for sharing

MentalMillennialMom

Wonderful post. I have genuinely never thought or opening an IRA but I think it could be very helpful for my future so thank you for this info.

P. Benson

Glad to help!

The Inimitable Path

Great post on a very important and under utilized tool. My coworker was asking me questions just the other day about what he should do with some extra income and one of the first questions I asked was it he has maxed out his IRA for the year.

P. Benson

Yes, that’s a great start. I’m glad he asked you.

Mihaela | https://theworldisanoyster.com/

Interesting information. It is differently named in the UK, but it works the same.

3 Steps to Deciding How Much of Your Paycheck to Save —

[…] READ MORE: Why You Should Have Money In An IRA Now […]