How to Make Your Money Grow Fast…ish

Want to make fast money? Newsflash: it’s not likely to happen. Most opportunities you come across to make quick money are a scam that can cost you. So take your time to explore your options. You want your growth to be able to replicate or repeat the growth for as long as you want. So how do you make your money grow fast-ish? Investing!

How Long Will it Take to Double Your Money?

Ever heard of the rule of 72? This tells you how long it would take for your money to double according to your interest rate. For example, if you have $100 in a savings account that is earning 1% interest, then it will take 72 years to double. You take 72 and divide it by the interest rate. The result is the number of years it would take to double.

How to Make Your Money Grow in the Bank?

Putting your money in a checking account where it grows no interest has little to no value. As a result, when my job direct deposits payments to my checking account, I immediately send the money to where it can see some growth. I have different savings accounts for different purposes. I keep savings accounts for my short-term goals like vacation, home expenses, and a sinking fund. The interest rates in these accounts vary from about 0.25%-1.0%. Not the best place for growth but perfect for keeping cash on hand for when I need it.

READ MORE: How many bank accounts could you possibly need?!

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Bank Bonus Offers for New Accounts

The fastest way to make money fast using a bank account: bank bonuses. Some banks will give you a bonus for opening an account with them. There are usually requirements such as a minimum amount or a certain amount of time you have to keep the account open. This offers cash that you cannot make by just keeping your money in a bank account. For this reason, some people do what is called bank bonus churning. Now I haven’t made much use of this. However, it is something I am interested in taking more advantage of in the future. If you’re interested in learning more, check out Doctor of Credit. There’s a comprehensive list of all sorts of bonuses, including bank account bonuses.

What Should You Invest In?

There are a variety of options but we’ll keep it simple here. We’ll go over investing in the stock market, real estate, and a business.

The Stock Market

Photo by Anna Nekrashevich from Pexels

By far the easiest way to invest in the stock market, in my opinion, is by investing in index mutual funds. You pick a mutual fund that follows an index or aspect of the markets. If you want to pick one that follows the total stock market, you choose a total stock market index fund. The name usually indicates what sort of fund it is but you can always just Google it to confirm. If you prefer ETFs, you can find the ETF version of almost any index fund or close. Also, something you can Google. The stock market usually provides returns of 6-10%. To make the math easy, let’s choose 10%. If you use the rule of 72, you will find that your money would double in 7.2 years. That is MUCH faster than putting money in a savings account. Also, if you needed the money, you could just sell your holdings (whatever it is you bought) and use that money. The rules about taking out the money differ depending on the kind of investment account you are using. So know the rules before you withdraw.

READ MORE: How to Invest – What You Need to Know About Using Mutual Funds

You can also buy and sell stocks, bonds, etc. Ideally though, if you’re looking for growth, you want to buy and hold your shares. Imagine if the person who bought Apple stocks when it was $2 sold it when it doubled. They would have missed out on its massive growth over the years. Currently Apple stocks are trading at around $120. For those who bought it at $2 and kept it all these years, their money have multiplied by 60x. So when investing in the stock market, it is recommended by many in the personal finance space to invest in companies that you believe in. As they grow, your money grows with them.

Real Estate

The great thing about investing in real estate is that when you buy a home, you have a tangible asset. This means you are getting a physical object for your money. A lot of people are more comfortable physically seeing what their money is buying. Also, if you needed money, you could sell the asset.

Another way to have your money grow in real estate is by investing in REITs (Real Estate Investment Trust). There’s an app called Fundrise that is popular for investing in REITs. You may be able to invest in REITs in brokerage accounts that you already hold. Explore your options there if investing in REITs is of interest to you. You can also invest directly with a firm. Investopedia has a great article on the different types of REITs. You can usually find your expected rate of return or interest on your investment. You can use the rule of 72 to see how long it will take to double your investment.

Start or Invest in a Business

A great way to see your money grow is by starting your own business. Is there something that interests you or that you enjoy that could make you money? Almost anything can be monetized today with the use of the internet. So explore your options. Google “how to make money doing [insert interest here]. If you don’t have any ideas, check out Pennyhoarder’s Start a Business page for inspiration.

You can also invest in a business as they do on Shark Tank. There are websites (for example, Start Engine) where you can join a business venture. Maybe there’s someone in your community who needs money to grow their business. Do your research. Much like investing in the stock market, you should pick a company you believe in.

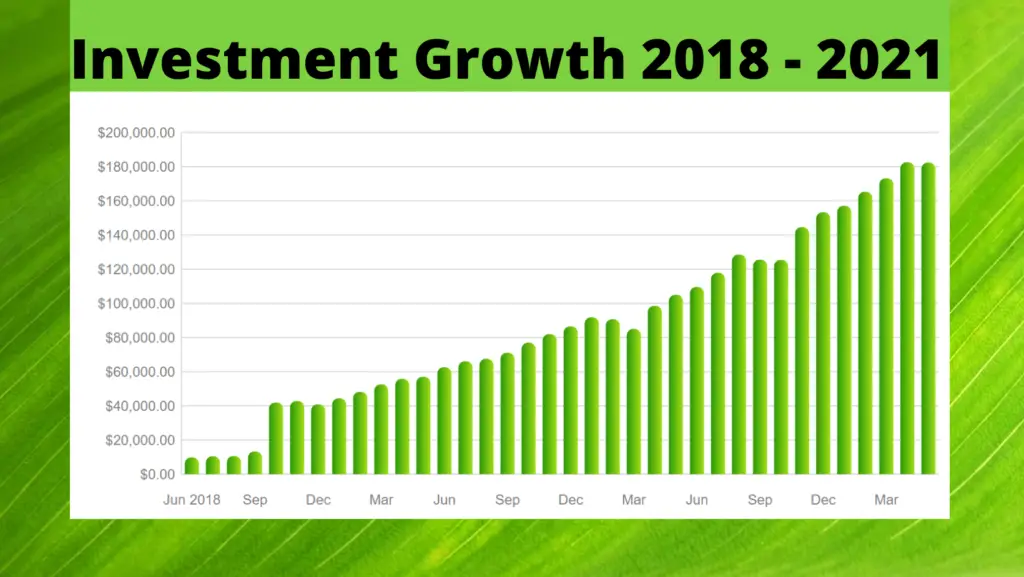

Those are some option to grow your money fast…ish. The fact of the matter is that these things take time. However, the beauty in investing is that as your money grows, the amount of time it takes to grow gets shorter and shorter. So I recently wrote about how I made my first $100K investing. I am almost at $200K now in less than two years DURING a pandemic.

Your turn. Are there other ways you can think of to grow your money quickly? Have you tried any of them? If you don’t mind, share what worked or didn’t work for you? Share in the comments below.

The Best Way to Successfully Build An Emergency Fund —

[…] get the most out of your emergency fund whilst it sits in the bank, it should be gaining interest. Growing your money is a very important part of having […]