Some people are hoping that the government will provide an extra stimulus payment of $1200 via the HEROES act. Or maybe you’ve been getting that extra $600 federal along with state unemployment. What have you been doing or plan on doing with that money?

Others are getting their third paycheck for the month. How is that possible? There are 52 weeks in a year. If you get paid biweekly or every two weeks, that means you get 26 paychecks a year. Some might assume that since there are about four weeks a month, then if you get paid biweekly, you get two paychecks every month. But that would mean you get 24 paychecks a year. However, since we’re going by the number of weeks rather than the number of months, there are two months where you get a third paycheck. For me, in 2020, those months are July and November.

If you fit any of the above categories, what are your plans for that money? A wise young woman named Bukola Ayodele said on CNBC’s Millenial Money said, “What doesn’t get measured doesn’t get managed.” So don’t let this moment pass without being intentional about what you want to do with that extra money. We want to avoid having to ask ourselves, “Where did that money go?”

Planning the Use of Extra Money

I would encourage you to think of what you plan to do when opportunities like this come around. I’m not saying you are going to get rich from it but it can help ease financial stress. This could help you tackle debt, build your emergency fund, save for a particular goal, start investing, etc.

Personally…

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

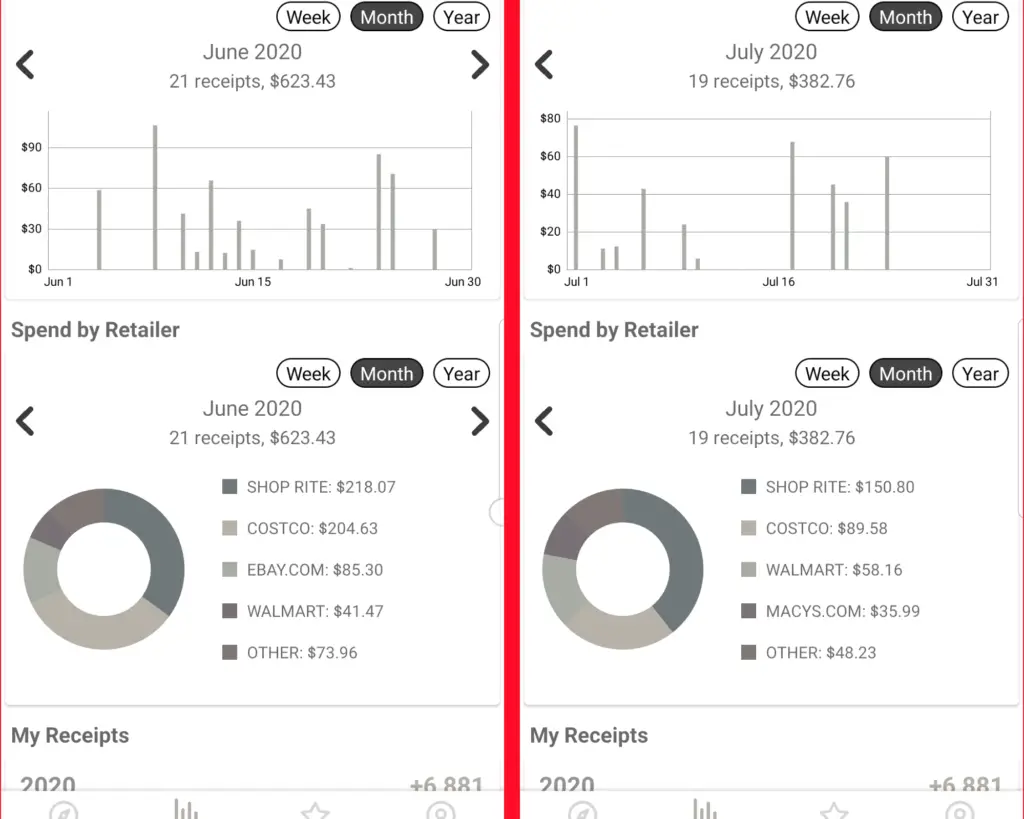

With every single paycheck, I pay off my cards in full. That works for me because my balance never gets out of control. Another reason this works great because I have curbed my spending TREMENDOUSLY over the last two years. As of late, my focus is on saving on my grocery bill. So I use Fetch (referral link) to not only upload receipts for points I could redeem for gift cards but to also track my grocery spending. If you use my referral code NU5YR and you’ll get 2,000 bonus points. Fun fact: you can now upload ANY receipt. It’s fewer points than you would earn on your groceries but it’s such a tiny amount of work.

So with this extra paycheck, I will first cover all my credit cards. I just bought some work clothes. Aside from that, my expenses are super low. Secondly, I will make an extra payment towards our car note. This will help reach our goal of paying it off by the end of the year. Finally, I’ll divvy up the savings toward our vacation account, condo account (household expenses), and my investment account.

Your turn.

To-Do List

- Write out your financial goals.

- When you get extra money, use it towards those goals.

Being intentional can help you meet any of your goals, not just the financial ones. So, what plans are you making with the extra money you’re getting? Share in the comments.

Also, if you want to make extra money, try renting or selling what you don’t use.

I love the reminder to remain intentional with income. I think a lax approach is the enemy of productivity, and being unproductive isn’t true to who I am. The quote from Bukola Ayodele is spot-on! Nice goal for paying off your car note, I can only imagine how much income that’ll free-up for you!! Happy Intentional-Planning!

Great post with awesome tips!

Thank you. Glad to be of help!

Great post! I always have a plan for our money as it comes in! I use Albert to track all our accounts and allocate it to different savings. It’s really helped us become financially stable, even in this hard time. Thanks for the tips-I might try out Fetch!

Being financial stable helps decrease financial anxiety. Great job on tracking your money.