How I Came Up With My Budget

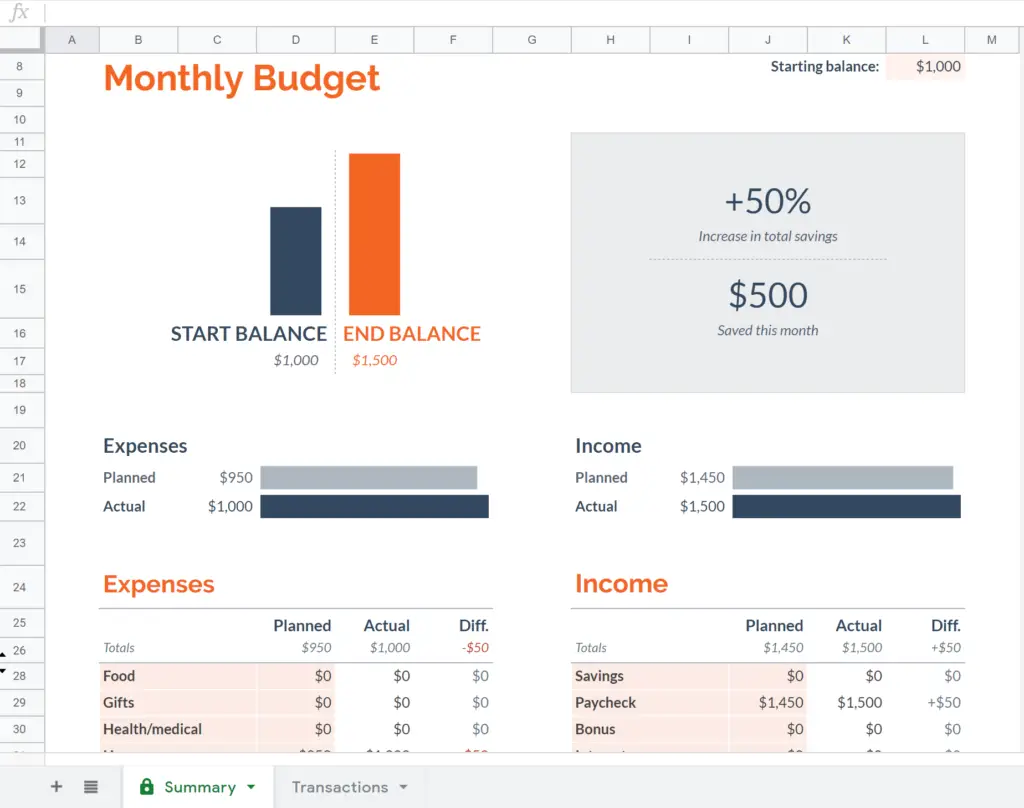

I started by figuring out what my current spending patterns were. Google Sheet’s Monthly Budget Template was used to keep track of where my money was going. I imagine Microsoft Excel and Apple Numbers has a similar template.

You enter every purchase and paycheck on the Transactions page. It’s tedious but it’s only necessary for 2-3 months to get a general picture of how you spend.

Creating budget categories

You can change the categories that are in orange which include expense categories, income categories, and the amounts you plan for each of them. You can use this to set goals and see how you’re doing meeting them.

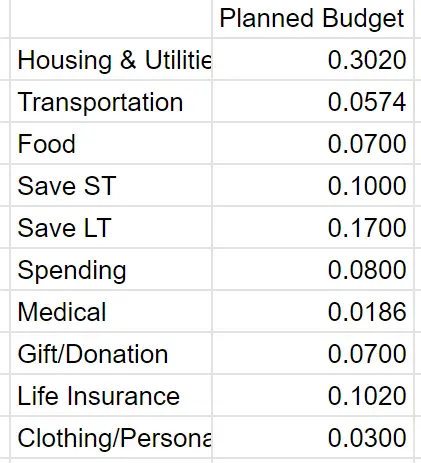

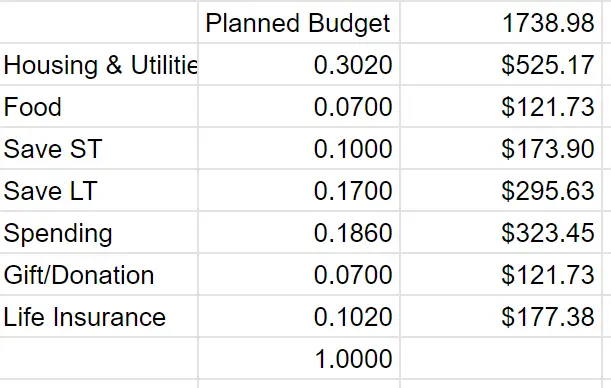

I like to apply percentages to my budget because I find it more flexible than assigning a solid number to anything. First, look at how much you make a month after taxes, so your net pay. To determine how much of your monthly income you spend on a certain line item or category, take the amount spend and divide it by your monthly net income. Start with costs that are fixed, meaning it’s the same every month. This may include your rent/mortgage, phone bill, internet/cable bill, and insurance. If you donate a certain amount monthly to an organization, you can add this to the list of your fixed expenses.

I was trying to be super specific but decided to simplify it significantly to the one below.

Perhaps, I might even consolidate food and spending soon to make it even simpler.

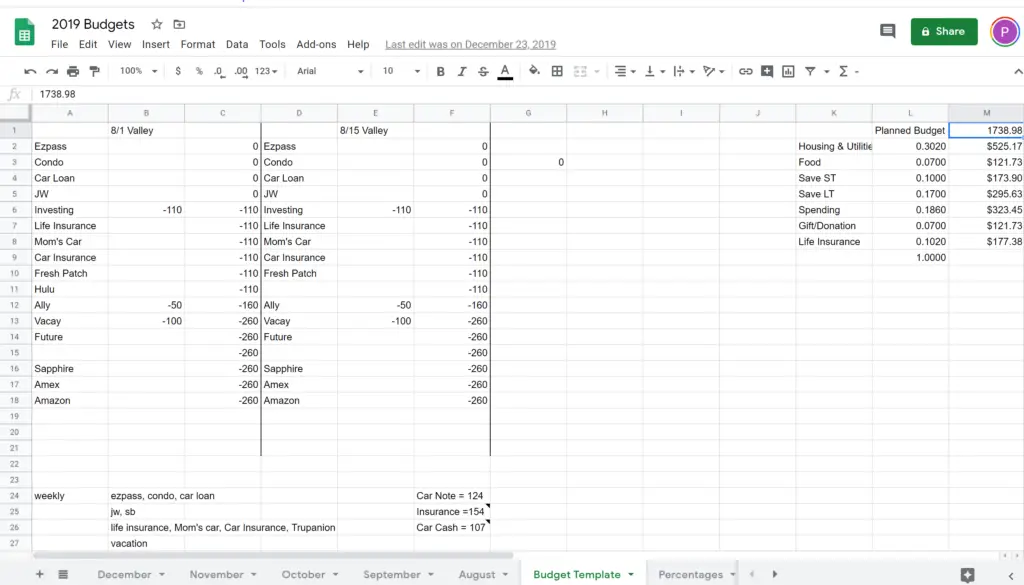

I enter my paycheck amount in cell M1 and because I set up my percentages, the spreadsheet automatically tells me how much I should put in each category. Additionally, I enter my individual paychecks in cell C1/F1 so I can decide how each paycheck will be broken down.

You do not NEED a spreadsheet to figure this out. It just works for me because I LOVE figuring out the math. There are apps to help you budget and a lot of bank apps also help you track spending.

To-Do List

- Start with figuring out how you currently spend and save your money.

- Decide what your goals are. Are you trying to increase savings, whether short-term or long-term? Are you trying to decrease expenses so your financial situation isn’t so stressful?

- Negotiate lower costs on bills like cable or internet.

- Find ways to make legit side money. If you’re a teacher, maybe tutoring online. If you’re a fitness geek, maybe teach a class at your local gym once a week.

What challenges do you face when creating a budget? Comment below.