My Money Journey

2018 was the beginning for a lot of changes in my life. Today, let’s talk about the money aspect.

Before 2018, I worked three or four (I lose count) per diem nursing jobs, which in the most basic of terms means I dictate how many days I work at any given job. It’s honestly a nursing superpower if you have an alternative way of having health insurance. You make more per hour and the flexibility is amazing. The trade-off is no benefits. You typically can still contribute to the retirement plan but no matching or pension. The other benefits like life insurance and disability, if you’re interested in them, you’d just have to pay into it or get them from an outside source.

Side note for nurses unfamiliar: per diem gigs usually require full-time experience (usually one year) before you can apply for them. So you can’t do it straight out of nursing school. Also, if you’re planning on changing specialties, you usually have to work full time in the new specialty before you can work per diem in it.

Whew! Ok, enough about that. I’ve always wanted to teach. My favorite part of nursing is educating patients and their families so that healthcare makes sense for them. That way they can be engaged in making good decisions in regards to their care. So I started looking for work that was more patient education focused. I currently work as a nurse navigator, a full-time salaried position with benefits. This means my gross pay is the same every two weeks. The beauty of this is that it makes planning for saving and spending every easy.

Choosing Benefits

- I already had health & dental insurance under my husband so I didn’t have to enroll in my new job’s health insurance.

- I also had my own life insurance so I didn’t pay for whole life at my job. Term life came included at no cost to me.

- Accidental death & dismemberment coverage comes at no cost to me. If someone can tell me the difference between that and life insurance, let me know. To me, it reads as more of the same.

- Long-term disability comes at no cost to me.

- Short-term disability costs $17.34 per pay period (pp).

- Accident insurance, that covers on/off job accidents for both my husband and I costs $11.38/pp. He’s in construction so how could that hurt to have?

- Group critical illness covers both my husband and I for $8.70/pp. It helps with costs not covered by insurance. Sounds like the Aflac commercial.

- Legal plan costs $8.31/pp. Because who doesn’t want a lawyer with them in traffic court?

So this made it so $45.73/pp came out for benefits.

Deciding how much to invest?

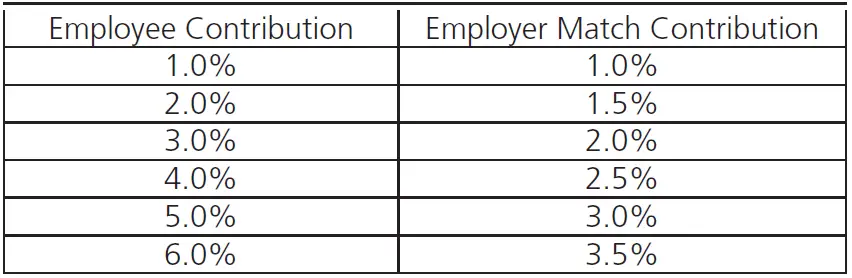

My employer doesn’t match until after 1 year of employment. This gave me time to figure out what I was comfortable with. I started with 4%. I believe that was the amount at the time to get the full match.

What’s great about deciding how much to invest in your retirement account is that you can always change it. You’re not committed to that number forever. Just start somewhere.

So I started with 4% and see what it felt like. After a month, I changed it to 5% ($161.84/pp). A month later, I changed it to 6% ($194.21/pp). I kept it that way until March 2019 when I changed it to 20% ($668.48/pp). Big jump right?

Around December 2018, I took a hard look at my spending. I used a Google Sheets template (so my husband can participate too) for a monthly budget so I can see where my money was going. We did this for a couple of months and realized I had extra money at the end of each check that I was completely oblivious to. I was likely spending it without noticing prior to my paying attention. So I figured out what the percentage of that difference was and changed my contributions to 20%.

Additionally, I opened a Roth and Traditional IRA. The reason I have both is because there are income limits to contributing to a Roth. If your household remains under that limit, then you only need a Roth. If you pass those limits as a household, you can only contribute to a Traditional IRA. Some years my household is over the limit, others we’re under. Last year, we were under so majority of my IRA contributions were under the Roth. This year, I’m not sure where we’ll lie so I stuck to the traditional. You can convert one to the other if you follow a bunch of rules so I might do that to make my Traditional a Roth IRA.

No matter if you have one or both types of IRA, the maximum contribution is $6,000 (if you’re less than 50 years old).

Family Budgeting

We tried this but my husband and I look at our money in different languages. What we did manage to do together is get certain costs down.

- My husband had a second car lease that we returned when that lease was up. Since this 2015 Honda Civic was never used, while we were waiting for that time to be up, we rented the car out on the Turo app.

- End of 2018, I sold my 2016 Hyundai Elantra. My husband takes the bus into the city for work so his car was sitting in the driveway Mon – Fri. I pretty much only work Mon – Fri so I started taking his 2016 Honda Civic to work. Now, we’re a one car household and we’re not going to get another car until this car has been run into the ground.

- This means our car insurance costs decreased from $4299.00 in 2018 to $2480.00 in 2019. I shop around for insurance twice a year. This year it will cost us about $1848.00. We look forward to paying off the car so we only have to have liability insurance. That should be late 2020 or the latest early 2021.

- My husband negotiated our monthly internet bill from $67.40 –> $37.49 in 2019. Increased costs now make it $48.49/month. Still less than $67.40.

- We decreased our eating out costs. We don’t eat out unless we’re invited by friends or if we’re mystery shopping. When we mystery shop, our meals are reimbursed so inherently, it’s free.

- We’re refinancing our mortgage so we save $275/month.

- We switched from Verizon which cost $198 for four people (about $50/person) to T-Mobile $264 for 7 people (about $37/person).

- We never had a cable subscription. Only pay for Hulu ($5.99/month) and T-Mobile covers Netflix which we gave to our friends to use since we don’t use Netflix much.

Changing my spending habits

One of the first habits I adopted is waiting to buy something non-essential. You know the feeling. You scroll past a product on the internet, maybe Amazon shows you a product related to what you’ve shown interest in, or maybe you’re watching a YouTube video and you want the kitchen tool they’re using. Perhaps you head to your preferred retailer’s site and you add the item to your cart. STOP!!!! Leave it there for two to three days and see if you still think you can’t live without it. I find that usually after this time passes, I already forgot I ever added it to my cart. If you found yourself thinking about it every day, then make that decision AFTER your two to three days.

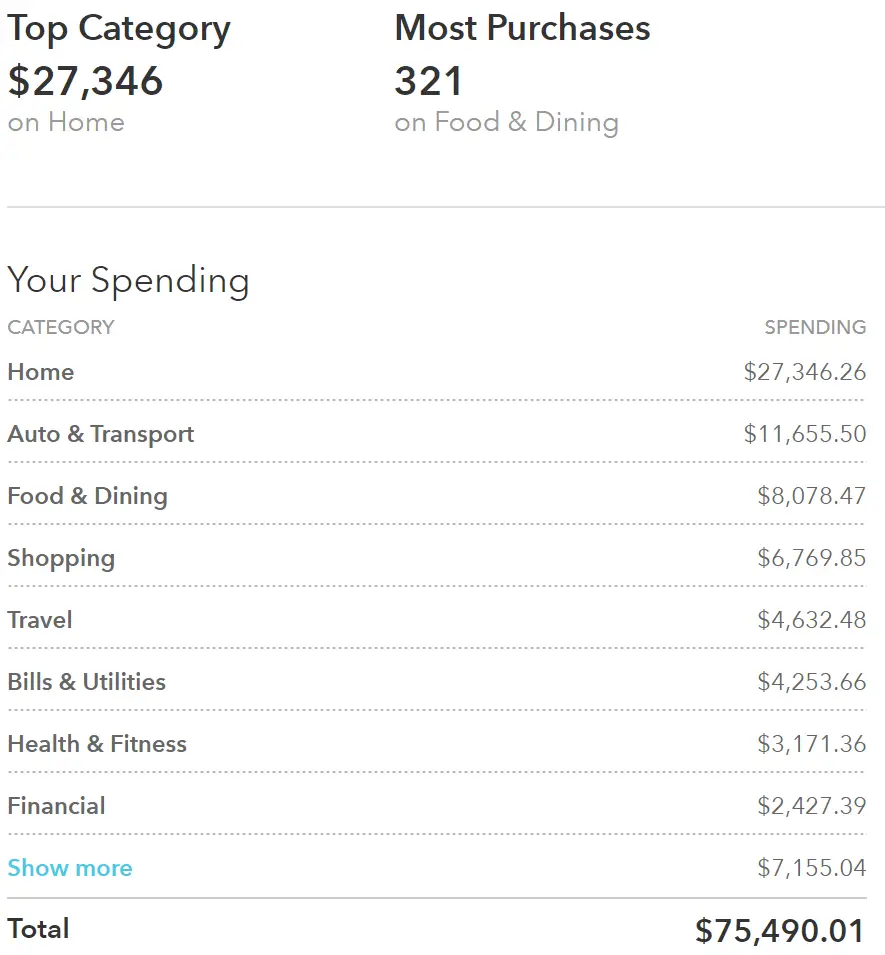

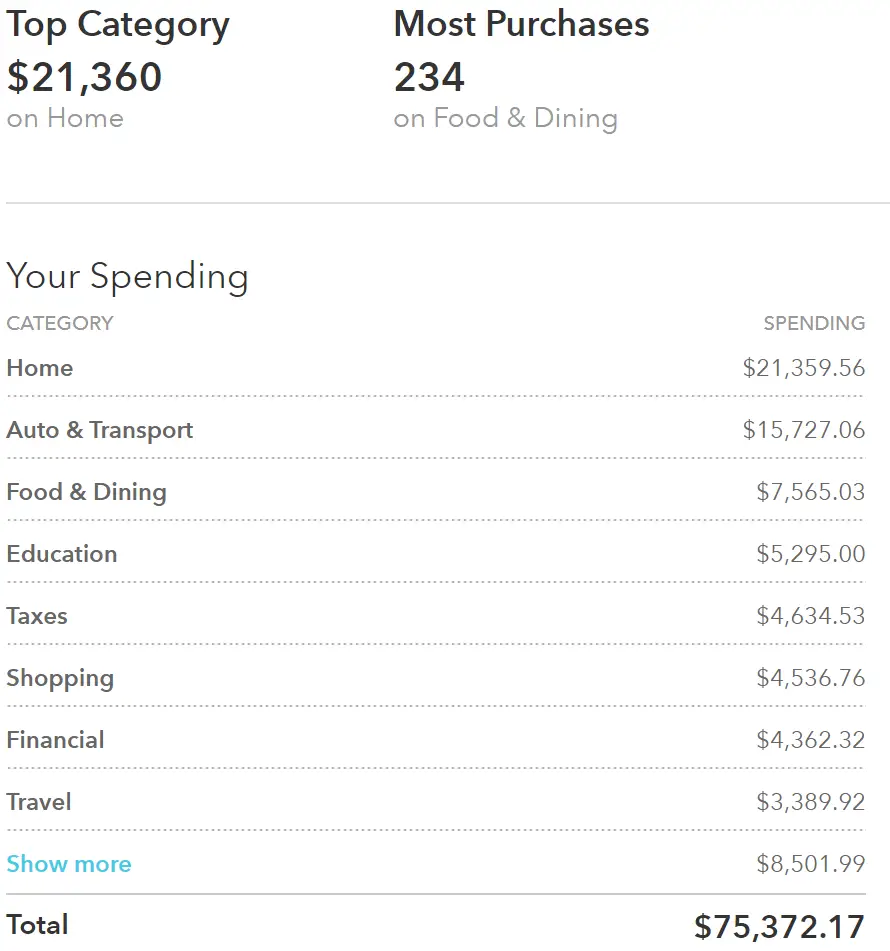

So if you look below, you can see the drastic differences between my shopping expenses in 2018 –> 2019. I also worked on spending less at the grocery store and eating out a lot less.

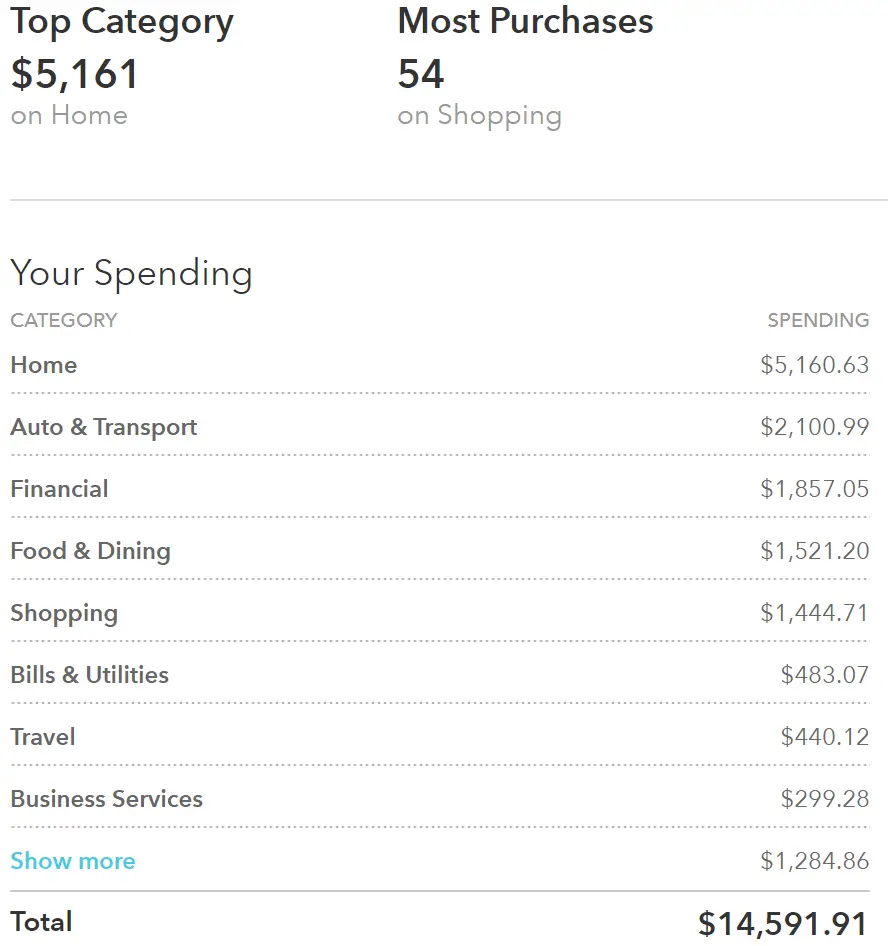

This year, I’m on track for a spending total of $56,600. Might be even less since COVID is severely reducing my spending.

So that’s $18,000-19,000 extra this year that I have to figure out what to do with. Last year, I contributed $18,478.51 to my retirement plans at two of my jobs. The annual limit of 2019, regulated by the federal government, was $19000. This year, the annual limit is $19,500 (if you’re less than 50 years old). I will aim to contribute the maximum.

Money Plans for 2020

- Contribute $19,500 to my employer sponsored retirement account. I’ll actually have to decrease the amount I’m contributing at some point so as to not pass the limit. First time I’ve had that problem. After meticulous calculations, I have to decrease my contributions to 12%.

- Contribute $6,000 to my IRA.

- Build up 6 months expenses in a high-yield savings account. For us, that’s about $20,500.

- Pay off car note. Use the money that paid the car note to make extra payments on the mortgage.

What are your money plans/goals for 2020? If COVID jacked that up, how are you adjusting those plans?

Three of My Biggest Financial Mistakes - Avoid Them! —

[…] you haven’t checked out my money journey, click here to learn […]

2020 Wins & Losses - How I'm Bringing in the New Year —

[…] work. Managing my money better has helped with that. You can learn more about my financial journey HERE. In choosing how to spend my money, rather than just spending it aimlessly, I have been able to […]

Do You Need a Financial Advisor to Manage Your Money? —

[…] have learned so much about personal finance in the last few years (see my Money Journey) that I find it unnecessary to pay someone for advice. I continue to listen to podcasts and read […]

4 Steps to Being Debt Free —

[…] People’s experience with debt is usually linked to their environment. On a personal note, as far as I knew my father didn’t carry debt outside from the mortgage and his car payment. My mom, on the other hand, was pretty comfortable with debt. Not saying she loves it but it doesn’t phase her. Early on, I was comfortable with debt because there was no huge anti-debt sentiment in my household. You can check out my journey by clicking here. […]

Buying a New Car is Brutal —

[…] choice to buy a car did not come easy. If you’ve checked out my money journey, you know my household of two went from three cars to one. And we paid off the car we did have in […]

3 Steps to Deciding How Much of Your Paycheck to Save —

[…] READ MORE: My Money Journey […]