How to save on your mortgage

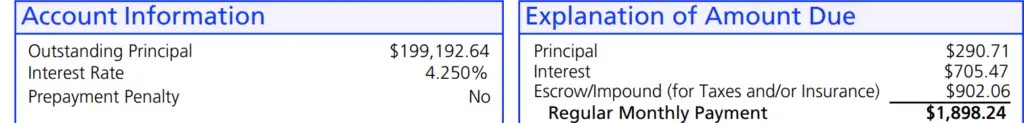

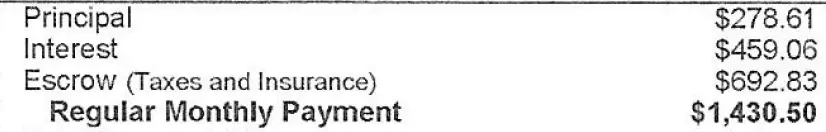

My husband and I bought our condo in 2015. I’ve already shared how we saved money on our mortgage by getting rid of PMI. This year, with interest rates so low because of the coronavirus, we refinanced. Our interest rate came down from 4.25% to 3.25%. Consequently (fancy word for ya), my mortgage payment went from $1,705.55 to $1,430.50. Let’s talk about what it means to refinance a loan so you can see if it’s the right move for you.

The original loan taken in 2015 was $202,500.00 for a 30-year term. In April 2020, the amount left on the loan was about $165,000. To refinance a loan means you’re going to a lender who will pay off your existing balance or amount left on the loan and now you own the new lender. So instead of having 25 years left on the loan, we now have a new 30-year term for the $165,000. Since we’re spreading the smaller amount over 30 years, then the payments are smaller.

Why does refinancing help you save on your mortgage?

For us, it was a few things.

- Our loan amount is smaller when you’re taking the new loan so the payments are also smaller. We’re going to take the difference of $275.05 and pay our car note. Hubby wants that note GONE by the end of this year.

- You save on interest. Nothing is more tragic than knowing so much of your payment goes toward interest rather than the loan itself. However, it’s less tragic when that interest rate decreases because, over the life of the loan, you’ll pay less in interest. Interest is, in essence, free money for the bank for providing you the pleasure of being in debt so the less you have to pay, the better.

Some people feel like refinancing is like starting your loan all over again which gives them pause when considering it. When you initially take out a mortgage most of your payment goes to interest. As time passes, more and more of your payment goes to the principal. So in 2016, if we take escrow out of the equation, about 30% of my mortgage payment ($996.18) went to the loan principal. In 2020, right before refinancing, about 41% of the same exact mortgage payment went to the loan principal.

Now after the refinance, about 38% of my mortgage payment ($737.67) goes toward the principal. Might initially feel like a small step backward for some. However, it won’t be long before the scale starts to even out again. Eventually, more of my payments will go toward principal than to the interest. The same will happen for you.

What if you don’t want to refinance for another 30-year loan?

If you don’t want to start over, you can save money on your mortgage by making principal-only payments. You have to make sure your bank won’t charge you for pre-payment and you can only make these additional payments AFTER you’ve paid your bill normally. Every bank website sets it up differently so get familiar with yours. This speeds up paying down the mortgage saving you interest down the line.

If the website doesn’t give you this option, then you can make a separate payment(s) in between your mortgage payments for whatever amount you can handle. In doing so, you catch the interest in its accumulation phase and most of your payment will go to the principal. This works best when you make those additional payments soon after paying your bill.

Another option is refinancing to a 15-year mortgage. Your payments will be higher but your interest rate will likely be lower than when you refinance for another 30 years. Please just make sure you can handle the higher payments. In these uncertain times, you don’t want to be stuck without the wiggle room.

What if you don’t have a mortgage?

So you can’t save on your mortgage but you can refinance other loans too. This includes the oh-so-popular student loans and car loans. To pay them down faster, the same above principles apply.

To-Do List

- Look at your loans and determine how much interest you’re paying on each of them.

- If your interest rate is no longer competitive, consider refinancing.

- Want to pay your loan down faster? Make additional principal-only payments.

What are you going to do with your newfound savings? Do you have an emergency fund? Have you started investing? Let me know in the comments.

Courtney

I LOVE this post! I think you explained the strategies and structure of mortgage pay-downs very clearly! Reminds me to focus on my goals. (Debt-free before I’m done with my 30s!)

2020 Financial Review - My Most Successful Year Yet! —

[…] in 2020, we refinanced the mortgage and paid off the car. These two things dramatically decreased our cost of […]

How to Save Money on College Costs —

[…] you’re currently experiencing student loan debt, refinancing might help you to obtain a better interest rate and lower your monthly costs. If you have loans […]

3 Steps to Deciding How Much of Your Paycheck to Save —

[…] READ MORE: How to save on your mortgage […]