2020 Financial Review – My Most Successful Year Yet!

I decided to take you through how I assess my financial situation for the year. I hope you find it helpful in forming your own goals and give you hope for your financial future. Also, if you have tips on how to improve that I haven’t thought of, I am open to learning. I’m going to use numbers you need to know to categorize my financial review.

Before we begin, an aside

For those who earn less than I do, please make an effort not to dismiss what is said here as unattainable. My ability to save is not simply because I make good money. Before being mindful regarding my money, I use to make more and save nearly nothing. Some people will have my income and save less while others can save way more. How you spend the money you make is far more important than your income.

Income

I received a yearly merit raise of 4.26% which became effective in April of 2020. This allowed me to increase my pre-tax retirement contributions from 20 to 21% comfortably. I am salaried so my paychecks are almost exactly the same every two weeks at about $1847 net.

READ MORE: How to Get a Raise

Expenses

I reside in a double income household so expenses are shared. So we look over the household expenses together to see if there is more we could do to keep them down. This is important to us because there are expenses that you can’t adjust on your own. So while those expenses rise, in our financial review, we look for ways to balance that out.

Decreasing expenses

So in 2020, we refinanced the mortgage and paid off the car. These two things dramatically decreased our cost of living.

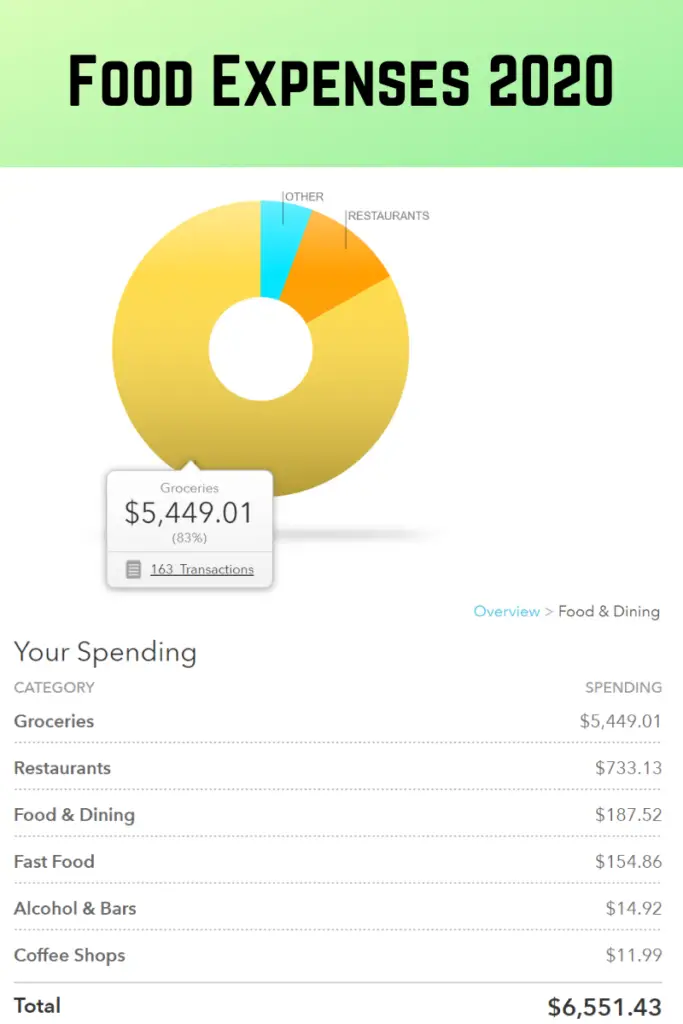

I aimed for a grocery budget of $500 a month. On average, I spent $454 a month. That required some diligence on my part because entering the grocery store can be dangerous. Additionally, I have been aiming to purchase high-quality and more sustainable food that is, unfortunately, more expensive. Meal planning, shopping my pantry first, and keeping to my grocery list has helped keep my food budget down. I think I could still do better though.

Shopping is kept to a minimum, mainly because I don’t like to do it. When we need things, we tend to just order from Amazon because I don’t have it in me to step into a store unless absolutely necessary.

But we can’t control it all

At the end of the year, we received notice that our condo’s HOA fees were going to increase in 2021 from $434 to $446 a month. Our property taxes are another expense that we have little control over and vary from year to year.

READ MORE: How to save on your mortgage ; Simple ways to save money on groceries ; 5 reasons to start meal prepping today

In Review

Our mortgage is $1616.04 + $446 in HOA fees means we’re spending $2062.04 monthly on our home. Our only utility bill is electric which varies from about $100-$180 a month, depending on our usage of course. That makes our total about $2200 a month.

Our car insurance costs $147 a month. Gas costs me personally about $30 a month. Sometimes my husband puts gas in the car if he’s taking it far. Toll costs vary dependent on our activities for the month but I usually put $50 on the EZPass every two weeks. So the car costs me $277 a month.

Add in the $454 I average of groceries a month and our necessary expenses add up to about $2931 a month.

How much I owe?

Fortunately, I have paid off my student loans and credit card debt in the past. My husband and I paid off the car so the only debt we have is the mortgage which is currently at $167,250.

How much am I saving and investing?

Before I’m even paid, I’m saving 21% in my retirement account which currently is about $730 per paycheck. I also aim to fully fund my Roth IRA at $6,000 a year. At a minimum, I add $100 to it every paycheck. My aim though is to put in about $300 a paycheck. And whenever I find extra money, I put most of it here. If and when I hit the $6,000 limit, then I use this same money and put it toward my traditional taxable brokerage account. Every two weeks, I add $10 to my Stash investing account. So every month I am investing from $1680-2000.

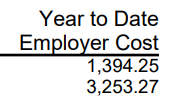

My job contributes to my retirement as well. Last year, they added $4647.52.

In terms of savings, every paycheck, I put $100 in our vacation account, about $550 in our condo account, $50 in my personal sinking fund, and $35 in our joint sinking fund. So in terms of short-term savings, I am saving $735 a month.

My husband is primarily responsible for putting money in our emergency fund. Our goal was to cover ALL our expenses in case of emergency for three to six months. We’re due for a money date, AKA our financial review, because last time we calculated how much we needed our mortgage was higher and we had a car payment. However, based on that meeting our emergency fund goal would be $15,000-$30,000. We keep some of it in an account with no debit card and the rest of it in a joint investment account. We’ve already met our minimum goal.

In Summary

2020 was a good year for my finances. I was able to maximize all my retirement accounts. I achieved my goal of spending $500 or less on groceries per month. The results of this financial review makes me confident in my financial plan thus far.

My goal for 2021 is to maximize my retirement accounts. I also want to be a little bit more creative in saving on my grocery bill. Aldi is a great store for providing healthy and organic/grass-fed options but my local Aldi runs out of the meat they have deals on quite often. I can try to speak to the staff about the best time to shop so as not to miss out. Otherwise, I’m thinking of just shifting these purchases to my local Trader Joe’s. Costco also has amazing options regarding healthy and sustainable foods which I love to take advantage of. So we’ll see.

Since the car is paid off, one of the topics for our next money date will be how we want to go about saving for the next car. I want to be able to buy it outright rather than financing it. We have to figure out which account we would use or if we’d start a new one. More to come.

I want to decrease our expenses so that I could put $300 or more toward investing much more consistently. This will occur likely after mom’s roof payments are done.

So that sums up my financial review for 2020. I’d like to know your thoughts on what you perceive to be the pros and cons of the steps I’m taking. Also, what conclusions have you come to when reviewing your finances? Share in the comments below.

Nisha

Thank you for sharing this Prisca! Not everyone is open about their finances and think it’s too personal.

I use a cashback service to insert all my shopping receipts, including groceries. It helps to save some money every month 🙂

What platform are you using to track your expenses?

P. Benson

I use Mint for general use and Google sheets to budget out each paycheck

How to Make the Best Use of Limit Orders —

[…] of my money is invested in index mutual funds. It makes investing simple with great results. So if you want to keep it simple, I would look for funds that fit what you are looking to invest […]