I broke $100,000 in November 2019. Quite honestly, I didn’t even know when it happened because I don’t really look. I created a lifestyle where my finances are more or less automated. But my sister and I were going over her budget. I was showing her how investments worked and she was shocked to see my balance. I still didn’t think much of it but it is an accomplishment. So let’s break down how I made my first $100,000 and how you can too!

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

1. You Need to Start so You Could be a New Investor

As I’ve shared, I started investing as a college student with no guidance on how to do it. I had no goal but I was told I should do it. Honestly, I am glad I did because it started the thought process behind investing. I did not make it a priority so the growth was minute but the seed was planted.

I contributed to my retirement plan at my first nursing job. However, when I left that job, I cashed it out instead of re-investing it. I knew there would be a penalty for doing that but at the time, I could not care less. I had credit card debt and it was a small amount so I didn’t think it would make a difference. Yea, I know better than that now. I would count that in the missed opportunity pile.

So if you want to make your first $100K, you need to start investing whether it is within your job’s 403b and/or a Roth IRA.

2. This Will Likely Require A Mindset Shift

I hated my first nursing job so I worked per diem nursing jobs in different areas of nursing. When I landed my dream job working at one of the top hospitals in NYC, I had consistent shifts working a job I loved with great co-workers. I eventually started contributing to my retirement account there in January 2016 at $100 per paycheck. In January of 2017, I increased my contributions to $200 per paycheck. It didn’t hurt that since we were unionized we got great annual raises. Still, there was no intention behind what I was doing. It was just clear to me that I could do more.

This retirement plan had the unique benefit of allowing you to contribute to both pre-tax and post-tax buckets at the same time. I’ve never seen this option before and have not seen it since. So in January of 2018, on top of my $200 per paycheck pre-tax, I also contributed $50 per paycheck post-tax. At this time, I had around $6,000 saved.

So take your investment contributions seriously. They should not be an afterthought and you should be intentional about doing it regularly.

3. Increase Your Contributions

New Beginnings – On the Way to 100K

In February 2018, I landed my dream gig working as a nurse navigator at a hospital in NJ. When I quit my NYC job, I rolled over the retirement account from that job to my new job. When I was onboarded at the new hospital, I started by contributing just enough to get the employer match when I became eligible.

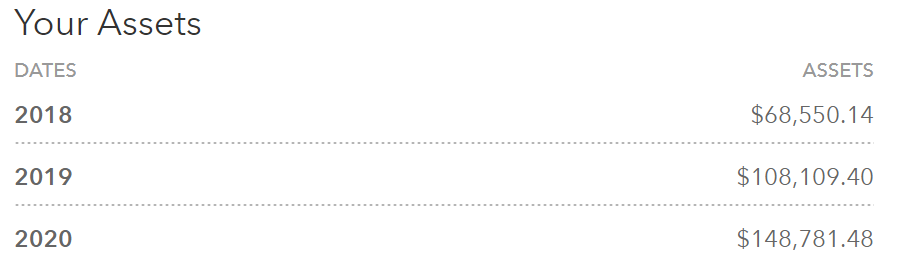

Once I realized I had enough room in my budget to contribute more, I adjusted it to 5% in May of 2018. I increased it one more time in June of 2018 to 6%. It remained here until March 2019 when I increased it to 7%. Now mind you, I’m still doing this based on comfort level. No real logic behind it. Even so, between my retirement accounts and the brokerage account that I’ve had since college, I had about $72,000 saved up.

So make a point of increasing your contributions as often as you’re able. Some jobs have automatic 1% increases annually. This is great but if you find that you can increase it 6 months from then, just log in and do it.

4. Obtaining Financial Literacy

I can’t remember why but in 2019, I started listening to the HerMoney podcast by Jean Chatsky. The podcast is focused on improving women’s relationships with money. This started the true growth of the seed that was planted way back when. I was learning more about all things personal finance in a way that made sense to me.

She interviewed Brad & Jonathan of the ChooseFI podcast and I was hooked! The idea behind financial independence (FI) was a concept I was grossly unfamiliar with until then. I had a job I loved so I was not interested in retiring early. However, not struggling financially and having the option to retire early if I wanted was quite appealing. I love my job now but what if a decade from now, I get a new boss that makes me miserable or my job no longer exists?

So I started listening to both podcasts regularly. There were regular people, just like me, learning about money, savings, and investing. It was like a light bulb went off and personal finance was no longer a mystery. I learned so much more about how to focus my investing efforts and decrease spending on things I did not value. I also read The Simple Path to Wealth by J. L. Collins. It is SUCH an easy read, like talking to a friend.

So there are several options for you to increase your financial literacy. Podcasts, Youtube videos, books, and classes are all good ways to learn to understand your money. Just find the information that aligns with how you want to manage your money. With this new information, you can make informed decisions about your money.

READ MORE: Tools For Financial Success

How Investing Made Me $100K

All I knew about investing growing up was to save for retirement. I didn’t know or value its long-term effects. I knew very little in the way of financial literacy. Despite all that, what my example made perfectly clear is that getting started is what is important.

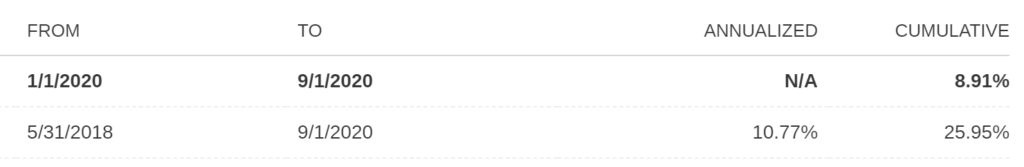

The above pictures the rate of return in one of my retirement accounts. I only work at this job once a month so the entire check gets invested. I haven’t worked there since March because of COVID. As a result, no new money has been contributed since. And yet, look at the rate at which it is growing.

Even though COVID created a shocking downturn in the market, I just rode it out. The result? My retirement account continues to beat any interest a bank account could offer and beats inflation (which is usually about 2% a year).

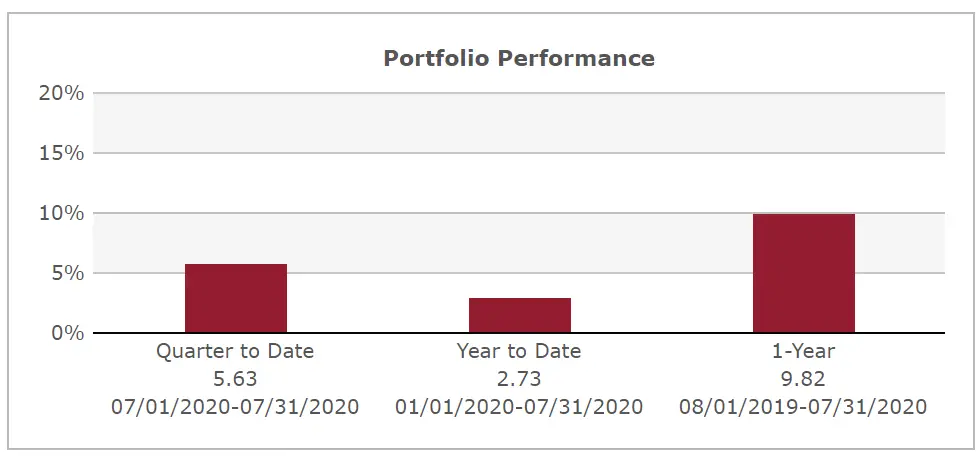

If you’re still not convinced, then take a look at the picture above. I calculated that between my job and I, about $25,000 was contributed to my retirement accounts and my brokerage account in 2019. If you do the math though, the value increased by nearly $40,000. Enough said!

To-Do List

- Before investing, have at least $1,000 in an emergency fund.

- If you have a retirement account at work, start contributing to it. The amount doesn’t matter, it’s the amount of time that matters.

- If you don’t have a retirement account, then you’ll have to find a brokerage account with which to open an IRA. Don’t know how to choose where to open one? Consider this article from Minted Millenials that outlines details you want to look out for when choosing a platform on which to invest.

- Do the best you can and stick to your routine.

- If financial literacy is your goal, check out this page for the resources that have helped me get to where I am now.

While people’s circumstances vary, there is very little about my money journey that is specific to me. Find the commonality and use it to your advantage. There are people of various backgrounds, income levels, and financial situations that are looking to invest in their future. It’s not just for the privileged.

Your turn. Have you started investing? If not, what is stopping you from doing so? Share in the comments.

Originally published in September 2020, this post has been updated by Prisca Benson.

Good for you!!! Super smart move 🙂

Thank you for this post! I found it really motivating as someone just graduating college and starting out in my career 🙂

What a great time to get started. Very exciting!

Great tips and inspiring story! I’ve saved over half a million in the last few years and once you get that first $100k down it just starts to snowball and grow if you’re investing it the right way.

Absolutely. I’m very excited to see that happen for me. I’m so grateful to have learned when I did.

Well done! Thanks for sharing your journey to your first $100K. Cheers to more!

This is amazing. And so smart to automate and forget about it. Inspiring story that makes me want to get serious about saving. Thanks.

Such a motivating post! I have been spending much of my young adult time learning about finance and terminology and all that Jazz. It is crazy but so important.

This was great, especially the point about investing through your job: “The amount doesn’t matter, it’s the amount of time that matters.” I agree with this a lot! Thanks for sharing.

You’re welcome. That’s the key to success.

Congratulations that’s fantastic!! Thanks for all the great tips too 😊

Congratulations on your success! Investing can be one of the smartest things you can do. Thank you for your insight!

Alyssa

great post, really interesting to read. thank you!

I will give it a good thought now I’ve read your inspiring story. Thanks for the tips!

You’re welcome. I hope this helps you reach your financial goals.

I was forced to cash out my retirement account to live on while I tried to find a new job after unexpectedly losing mine. Then the pandemic hit, so finding a job was eliminated but I invested part of my retirement savings into starting my blog, which I am currently working on monetizing. I am curious to know what you mean by “rode it out.” How did you manage to do that without touching your retirement? Did you lose your job on did you stay on payroll as a nurse? Before I lost my job as a teacher, I contributed $250 from every check (26 per year) for almost 4 years and had nearly $30,000 saved. Now I just have a small retirement savings from I teaching position I had for 7 years and will have to build on that. I admire your enthusiasm on this subject! I know it’s important and I definitely aspire to keep an emergency savings and I am eager to begin investing in real estate, but retirement savings is not something that has maintained my focus. 😔🙏🏽

I’m sorry that happened to you. Losing a job is always a possibility. This is why having an emergency fund is vital so hopefully you don’t have to touch your investment accounts.

What I meant by rode it out is that I didnt sell my holdings like a lot of people did.

I wish you the best in reaching your goals.

Thank you for sharing how you made your first $100,000. It’s an interesting read, and certainly an inspiration.

Thank you for sharing! We are getting into investing too— so far so good!

I am glad to hear it. What a great start for you and your family!

Wow this is so inspiring! I gotta get my investing into gear once I finish grad school!

Love,

Charline